Overview:

The American Cancer Society Cancer Action Network (ACS CAN) empowers advocates across the country to make their voices heard and influence evidence-based public policy change, as well as legislative and regulatory solutions that will reduce the cancer burden. As part of this effort, ACS CAN deploys surveys to better understand cancer patient and survivor experiences and perspectives, through our Survivor Views research panel. The panel is a group of cancer patients and survivors who respond to regular surveys and provide important insights to support ACS CAN’s advocacy work at all levels of government.

Fielded March 18-April 14, 2024, our latest survey explores medical debt among cancer patients and survivors as well as financial tools and policy solutions to address medical debt. The web-based survey was conducted among 1,284n cancer patients and survivors nationwide who have been diagnosed with or treated for cancer in the last seven years, including 599n who have had medical debt related to their cancer and 456n currently holding medical debt related to their cancer.

Key Findings:

-

Nearly half of cancer patients and survivors surveyed (47%) have had medical debt related to their cancer, and the plurality of those (49%) have carried over $5,000 in medical debt. Sixty-nine percent have carried this debt for more than a year and over a third (35%) have had medical debt related to their cancer for more than three years.

-

Nearly all (98%) were insured at the time when the debt was incurred, most commonly by a high deductible health plan without a health savings account (34%).

-

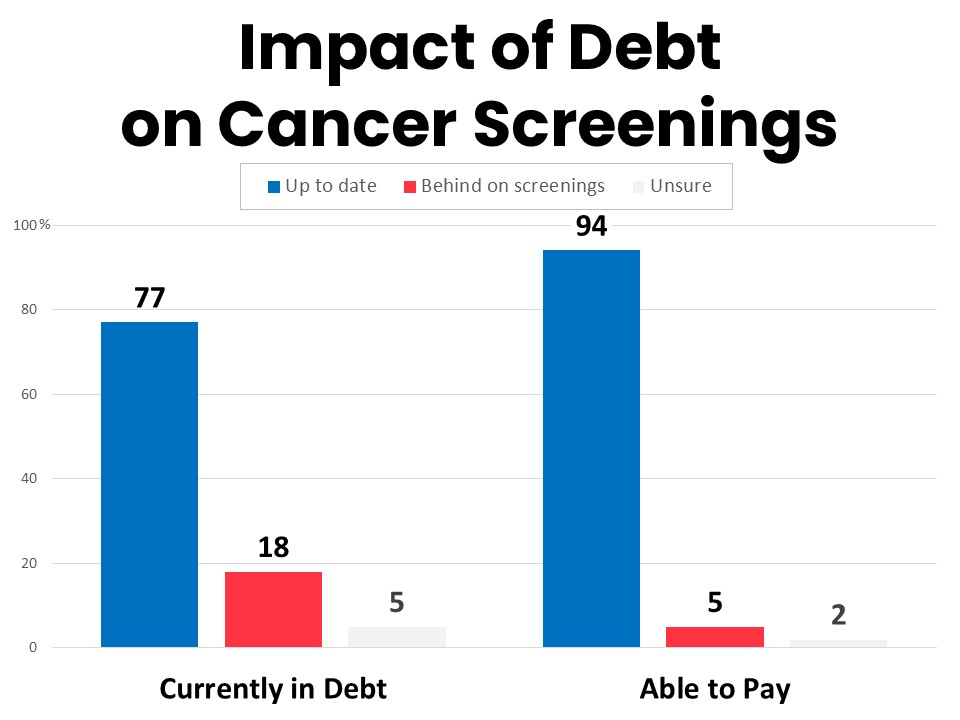

The health implications are significant: those with cancer-related medical debt are three times more likely to be behind on recommended cancer screenings (18% vs 5%), 27% of those with cancer-related medical debt have gone without adequate food, and 25% have skipped or delayed care.

-

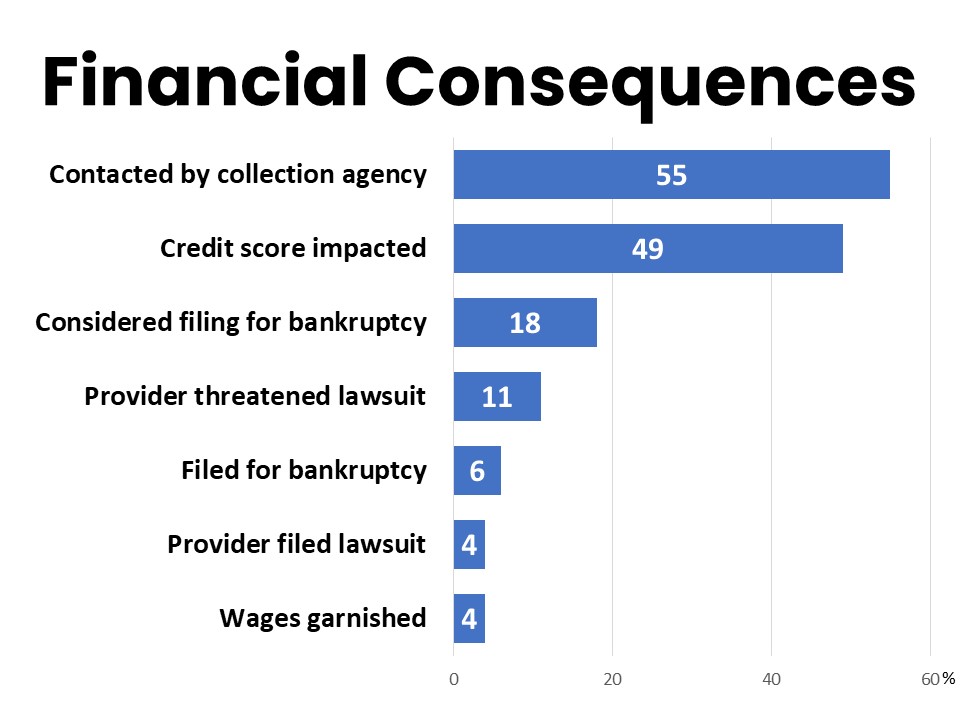

The financial consequences of cancer-related medical debt can also be significant: nearly half (49%) saw their credit scores decrease and 30% had difficulty qualifying for loans.

-

The impacts of cancer-related medical debt are not felt equally and further deepen disparities. Black and Hispanic patients and survivors with medical debt are about twice as likely as White respondents to report being denied care due to their debt (13% and 14%, respectively). Black respondents are also more likely to report being contacted by collections agencies (66%) and to feel harassed by them (44%).

-

Respondents support a multifaceted approach to addressing medical debt, with several policy improvements deemed helpful to reducing the burden of medical debt on cancer patients and survivors.

Detailed Survey Findings:

Nearly Half of Cancer Patients and Survivors Have Medical Debt Related to Their Cancer

Nearly half of surveyed cancer patients and survivors (49%) have had medical debt and 47% have had medical debt related to their cancer. Another 13% anticipate incurring debt related to their cancer in the future (primarily those just recently diagnosed), while 34% say they have been able or expect to be able to pay for their cancer care without incurring debt. Among those diagnosed within the past three years, 50% have had debt related to their cancer and 18% expect to in the future.

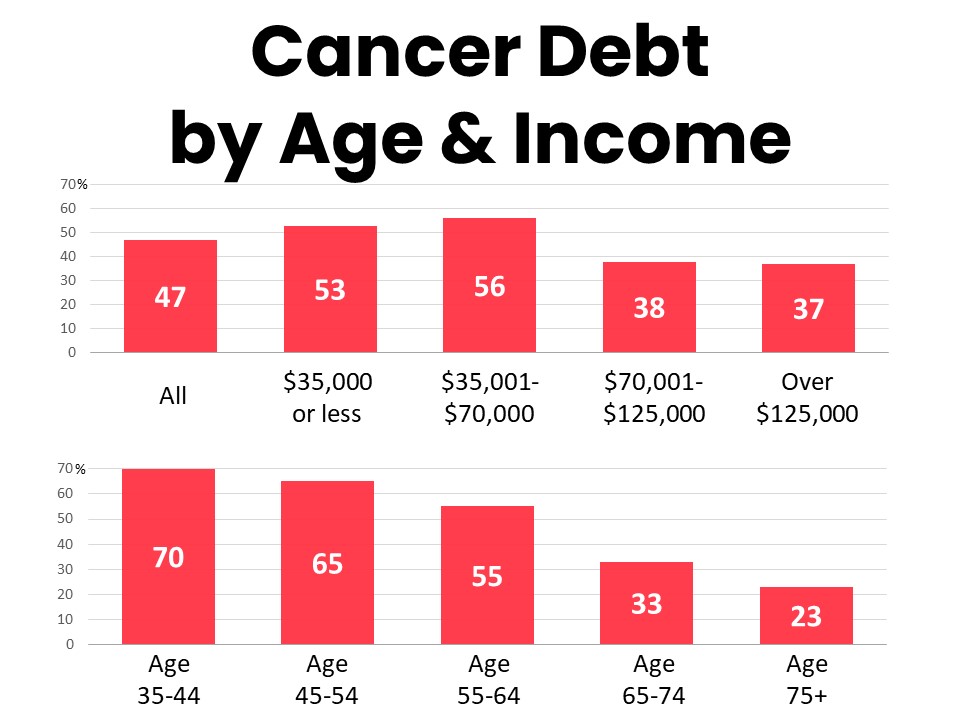

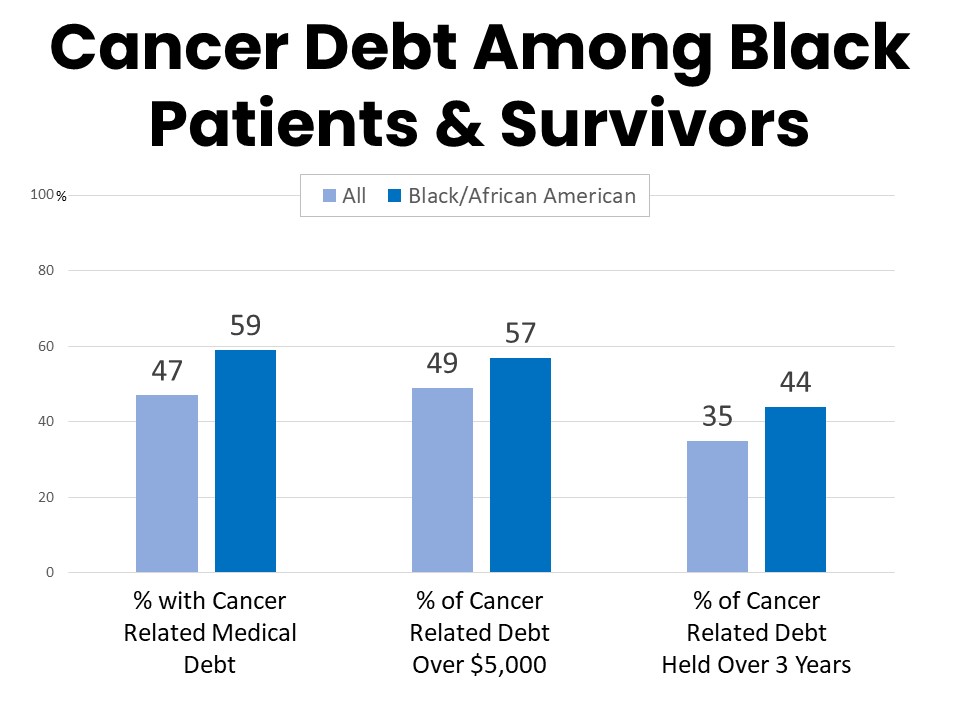

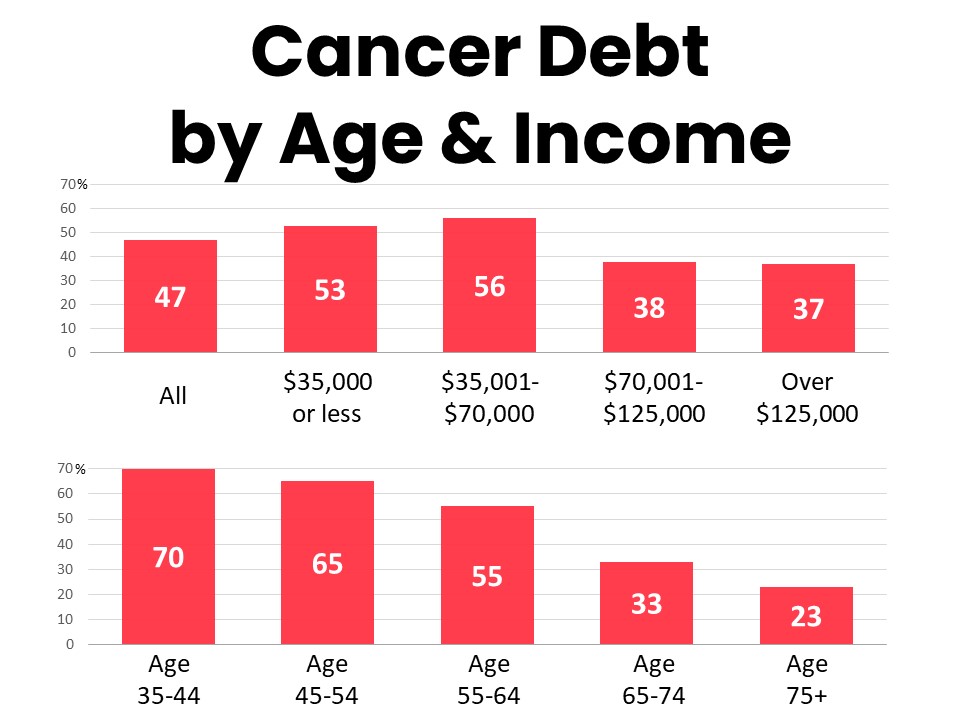

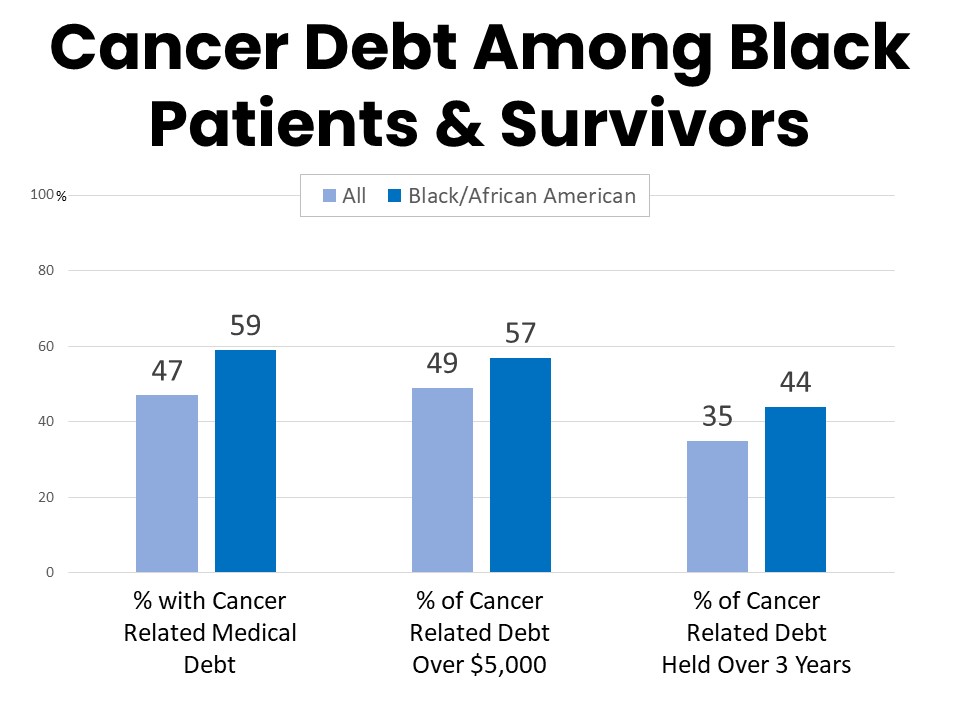

Even among the highest earning households (those with over $125,000 in annual household income), over one-third (37%) have been unable to pay for their cancer care without incurring medical debt. Recent studies have shown an increase in cancer diagnoses in younger age groups and younger cancer patients and survivors are particularly impacted by medical debt. Seventy percent of those age 35-44 and 65% of those age 45-54 have incurred medical debt related to their cancer. Black cancer patients and survivors are more likely than others to report cancer-related medical debt (59%), as well as higher total amounts and duration of cancer debt (noted below). Residents in the South (54%) and Midwest (53%) are significantly more likely to have cancer-related medical debt than those in the Northeast (37%) and West (42%). Fifty-seven percent of those in states that have not yet expanded Medicaid have had medical debt related to their cancer compared to 47% of those in states that have implemented expansion.

Among those with cancer-related medical debt, about half (49%) have carried more than $5,000 in debt. Sixty-nine percent have held their medical debt for more than a year and over a third (35%) have had medical debt related to their cancer for more than three years. The burden is even greater among Black respondents who have had debt related to their cancer; 57% report cancer debt of more than $5,000 and 44% report carrying the debt for over three years.

Those with cancer related medical debt often have held multiple forms of debt. Unpaid medical bills due to a health care provider (72%) and other debt owed directly to a provider such as a payment plan (45%) are the most common. Thirty percent have had cancer-related debt on a regular consumer credit card while 21% have carried debt on a medical credit card. Twenty-two percent have owed friends and family debt borrowed to cover the costs of their cancer care, while 15% have used bank loans including installment loans and home equity lines of credit to pay for cancer care.

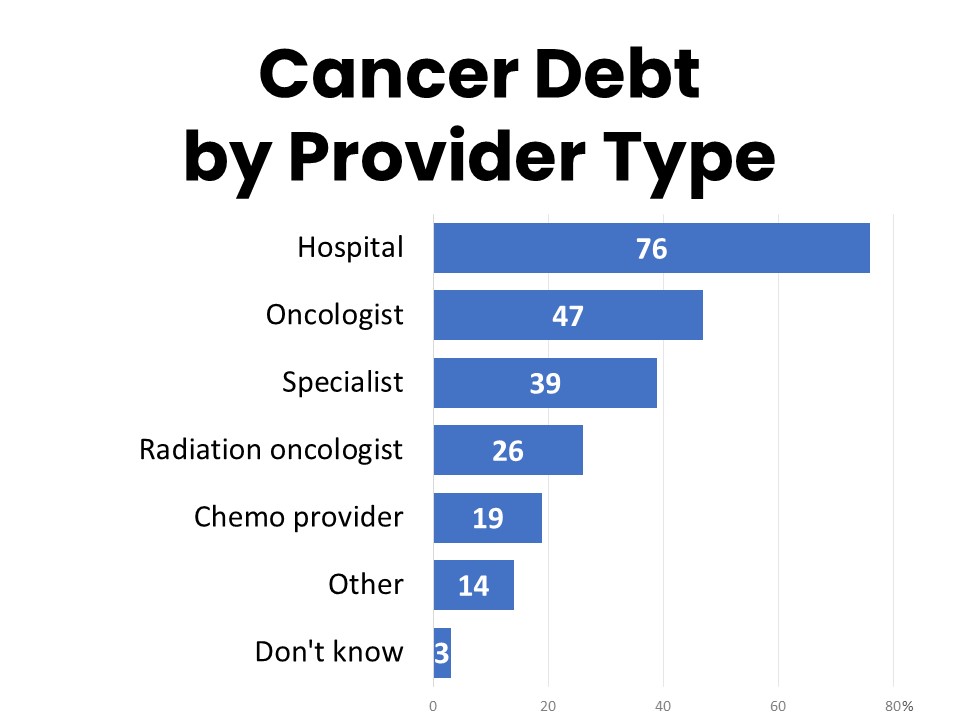

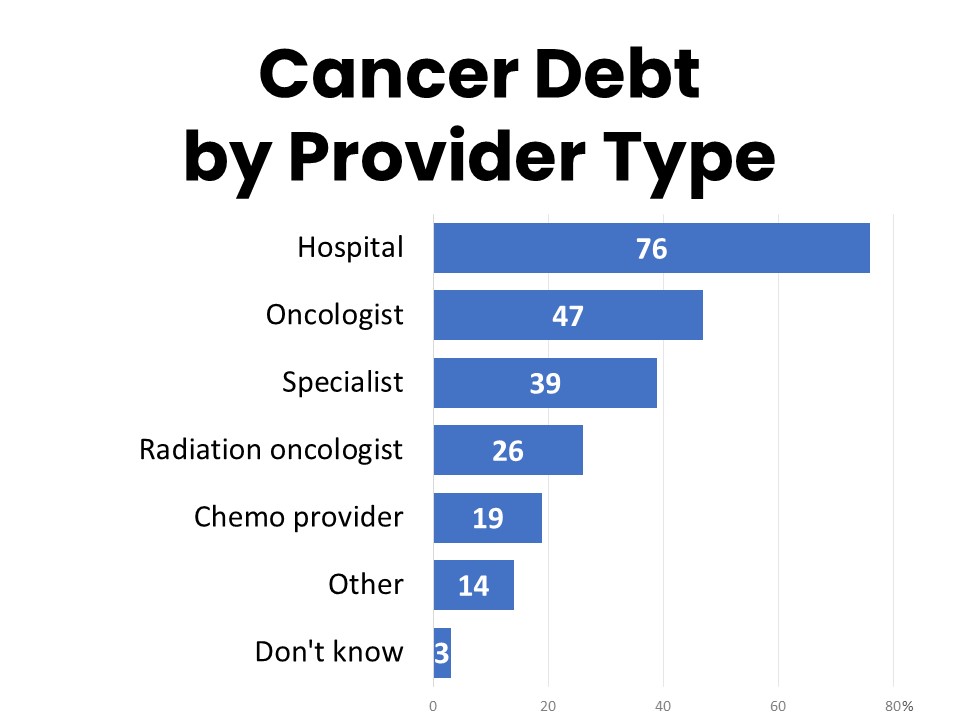

Hospitals are the most common provider to whom cancer patients and survivors are indebted, with 76% of those holding medical debt owing a balance to a hospital. By comparison, 47% have been in debt to their oncologist, followed by other specialists (37%), radiation oncologists (26%), and chemotherapy providers (19%), when these are separate from the hospital.

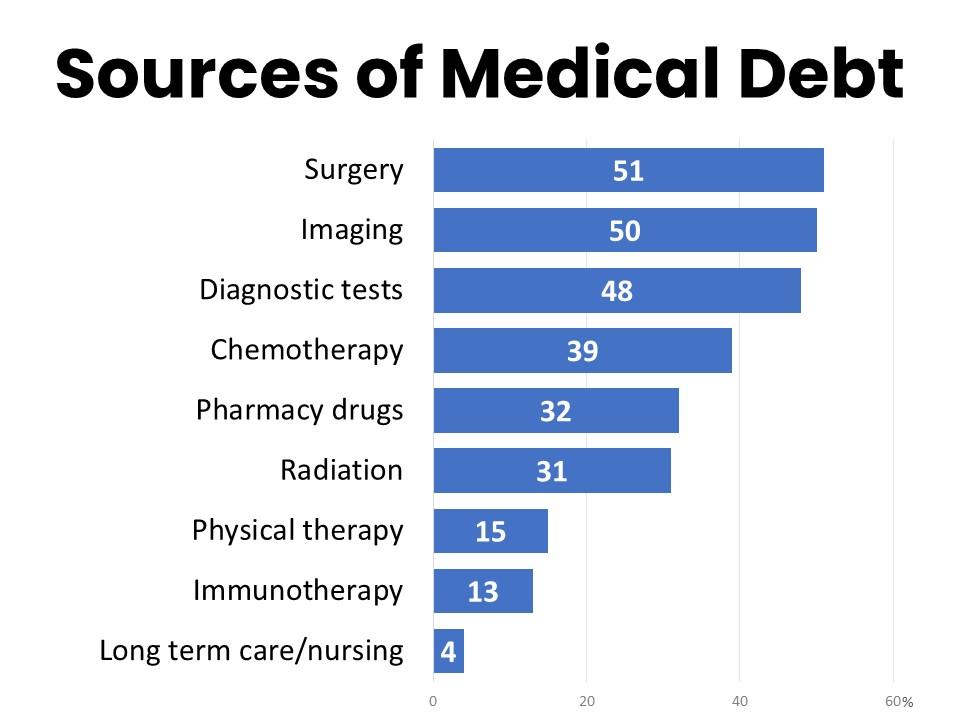

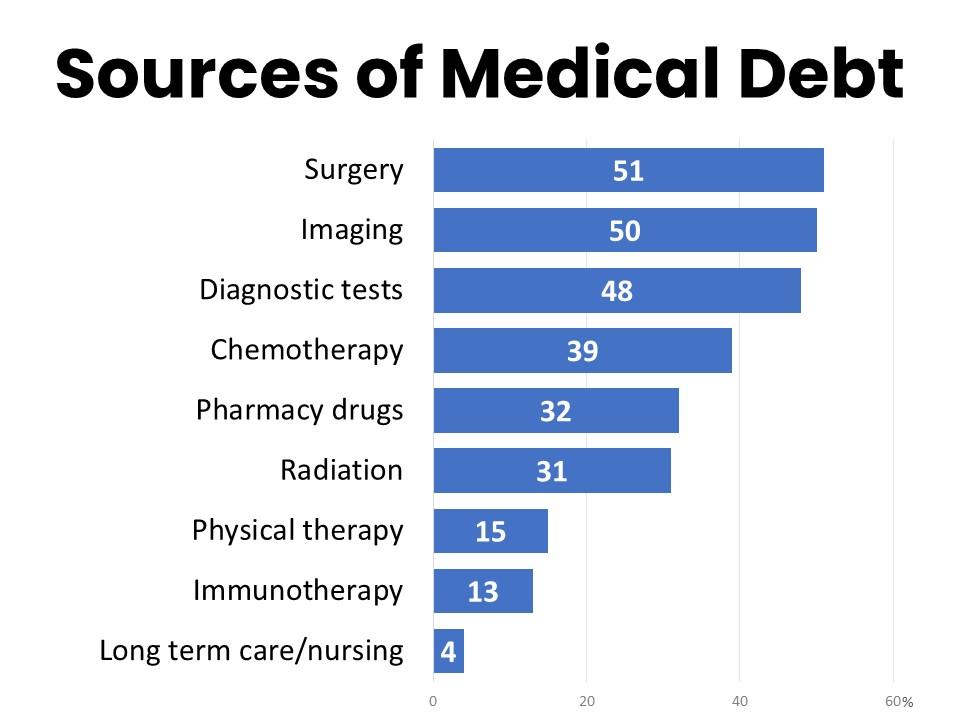

Surgery (51%), imaging (50%), and diagnostic tests (48%) are the most significant sources of unpaid medical bills or other debt related to cancer care, followed by chemotherapy (39%). Pharmacy drugs (32%) and radiation (31%) are mentioned by just under a third of those holding cancer-related medical debt, while physical therapy (15%), immunotherapy (13%), and long-term care/nursing (4%) are less commonly noted as significant sources of medical debt.

Nearly All With Cancer Related Medical Debt Were Insured When Debt Was Incurred

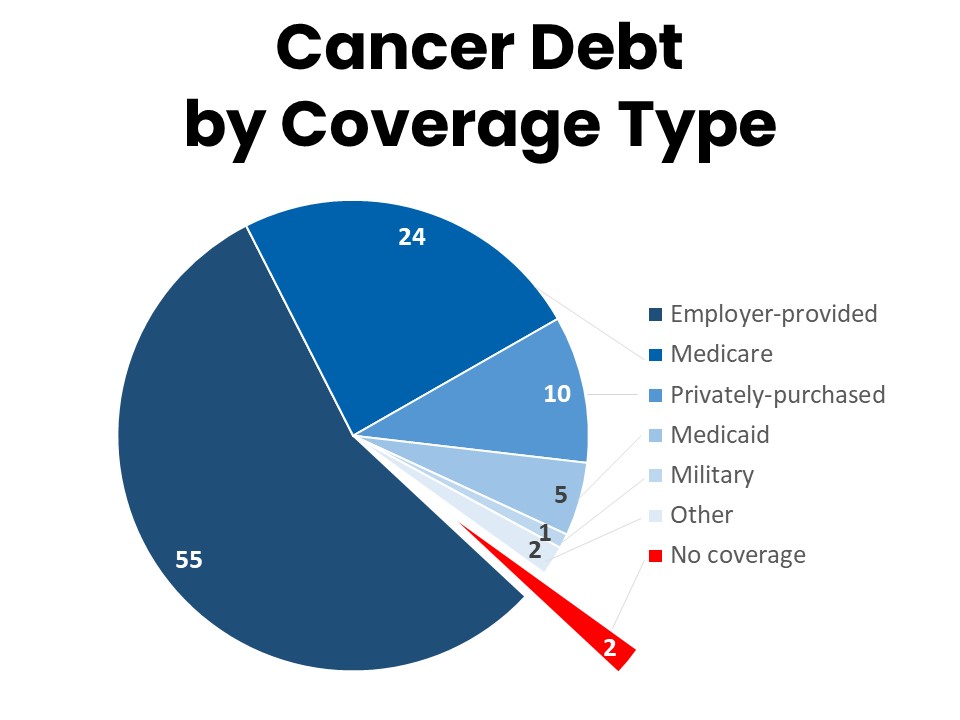

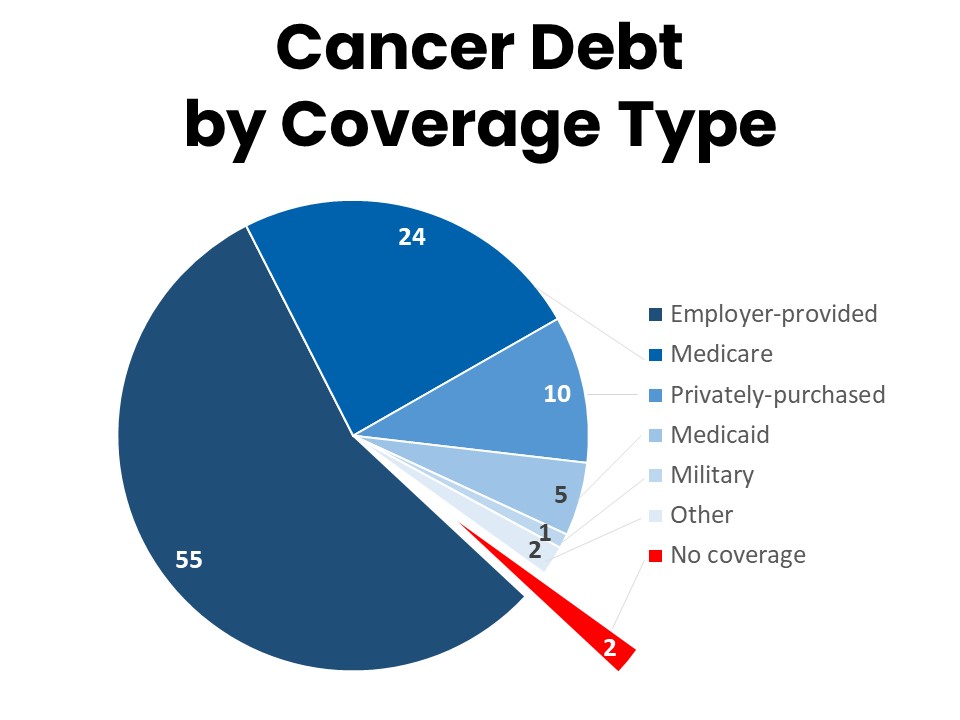

More than half (55%) of cancer patients and survivors who have had medical debt related to their cancer were covered by an employer-provided insurance plan as their primary coverage at the time they accrued the debt. Just under a quarter (24%) were enrolled in Medicare and 10% were covered by a privately-purchased or marketplace plan. Five percent were enrolled in Medicaid and only 2% had no coverage at all. A plurality (34%) were enrolled in a high deductible plan without a health savings account (HSA), while 19% were covered by a low-deductible plan, and 12% had a high deductible health plan with an HSA. Another 19% are unsure what type of plan they had at the time, and 8% changed plans during the time they accrued debt related to their cancer.

Two-thirds (67%) of those currently holding debt related to their cancer care expected their health care policy to cover more of the costs of their cancer care than it did. Thirty percent of those who have had debt related to their cancer care would have changed something about their treatment if they had known they would have medical debt, such as seeking less expensive providers (11%), declining some treatment (11%), or even declining all treatment (2%). Nearly all (97%) of those who currently have medical debt related to their cancer are concerned about being able to afford their health care costs, with 57% very concerned. Similarly, 98% of those currently carrying cancer-related debt are concerned about incurring additional debt when they use the health care system, with 63% very concerned.

Those with Cancer Related Debt are Three Times as Likely to be Behind on Recommended Screenings, Among Other Health Impacts

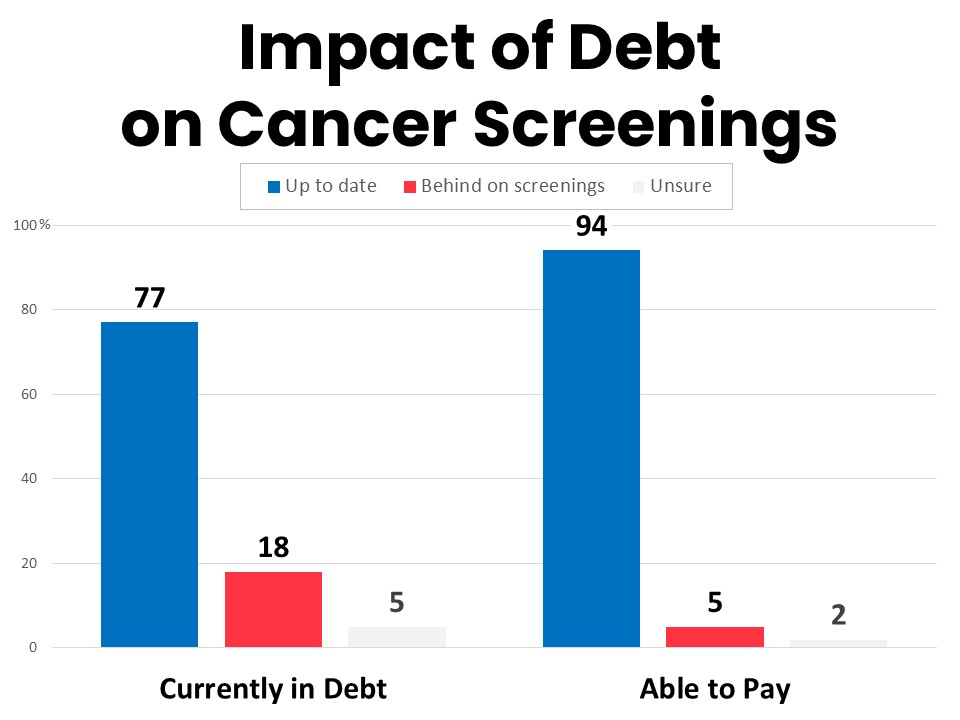

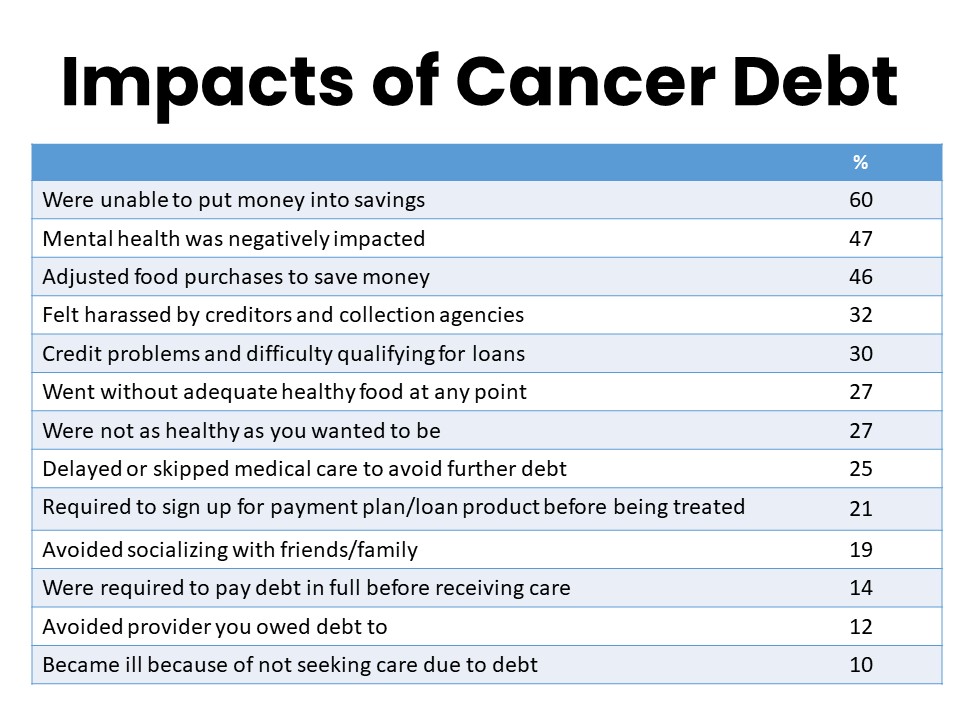

Those currently in debt due to their cancer care report several ways that their medical debt has impacted the health care they receive. Critically, they are less likely to be up to date on their recommended cancer screenings than those who have been able to pay for their cancer care without incurring debt—77% of those currently in debt are up to date on their screenings compared to 94% of those who have been able to pay—and they are more than three times as likely to say they are not up to date on their recommended cancer screenings as those who have been able to pay for cancer treatments without incurring debt (18% vs. 5%). One-quarter (25%) have delayed or skipped medical care to avoid further debt. One-in-five (21%) were required to sign up for a payment plan or medical credit card before they could be treated and 14% were required to pay in full before they could be treated.

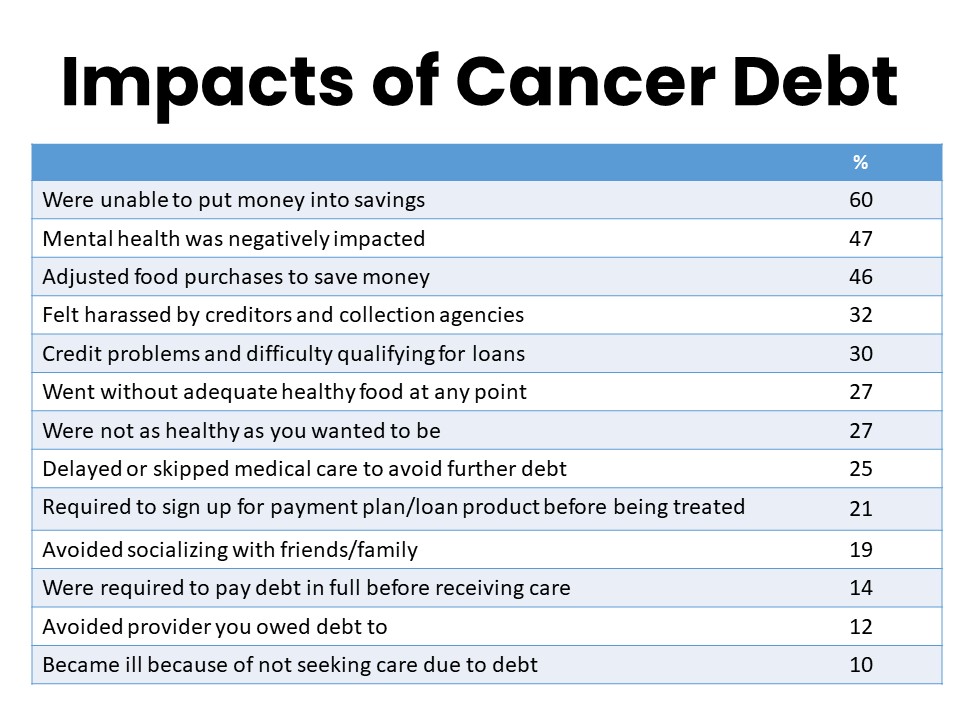

In addition to risks such as delayed or missed diagnoses due to falling behind on recommended cancer screenings and care, carrying medical debt has other implications for patient health. Nearly half of those who have had debt related to their cancer report negative impacts on their mental health (47%), while more than one-quarter report going without adequate food due to their debt (27%). Another 27% say they were not as healthy as they wanted because of the impacts of their medical debt. Recent studies have linked social isolation to negative health outcomes, and 19% of those with cancer related medical debt say they have avoided socializing with friends or family due to their debt. Ten percent say they became ill as a result of not seeking care due to their debt.

Cancer Related Medical Debt Has Broad Financial Impacts

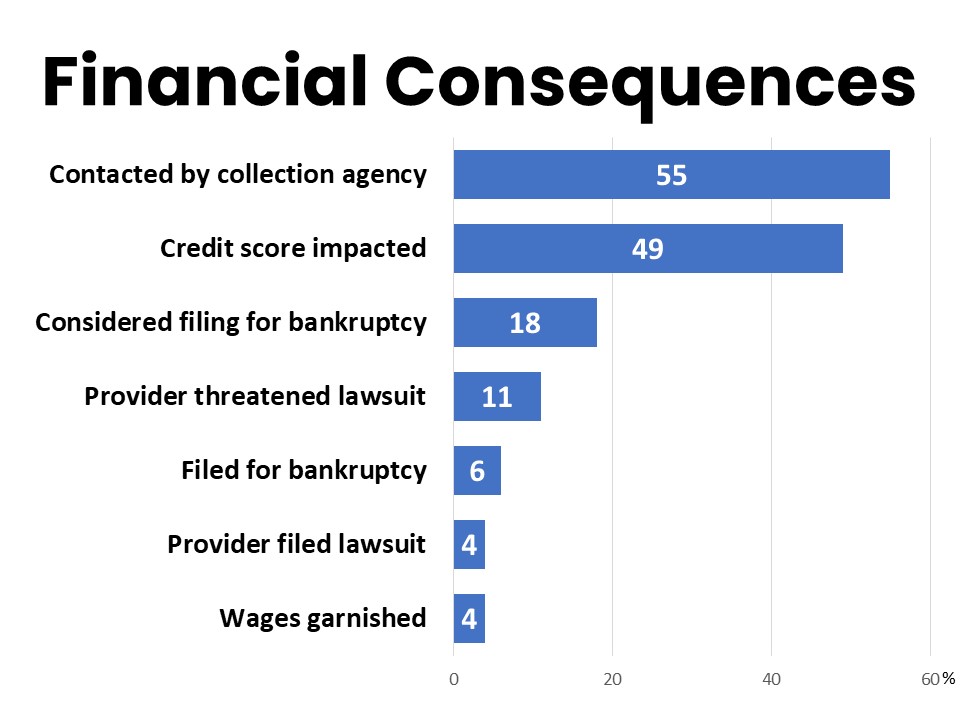

Those who have had medical debt related to their cancer also experience cascading financial impacts. A majority report being unable to put money into savings (60%), while nearly half (49%) say their credit score was impacted and 46% felt harassed by creditors and debt collectors. Thirty percent experienced credit problems and difficulty qualifying for loans. Eighteen percent considered filing for bankruptcy and another 6% ultimately did file for bankruptcy. Eleven percent say a provider threatened a lawsuit against them and 4% report a provider filing a lawsuit. Eight percent lost their home or had to live somewhere they did not feel safe due to their medical debt.

Cancer patients’ and survivors’ personal experiences shed light on the extent of the toll medical debt can have…

“I went in for a mammogram and ended up needing ultrasound, blood work, etc. I expected to pay nothing for the screening and ended up with over $5,000 in bills. I’m supposed to be screened every six months and I'll never pay off the debt before the next screening. I am retired and stressed about all the debt piling up.”

“As a 68-year-old seven-time 28-year cancer survivor who is currently in treatment for an eighth occurrence, medical debt has had a tremendous impact on my life. I withdrew my retirement fund to pay medical bills and I must, therefore, continue to work at least part-time to supplement my Social Security benefits.”

“My medical debt has caused depression, anxiety, and panic attacks. I’m reluctant to pursue care for other health concerns. I lost my home due to foreclosure and lay awake at night in fear, wondering what to do.”

“I can't afford all the medications my doctor has prescribed for me, so I stopped picking them up at the pharmacy. I canceled appointments because I couldn't afford the co-pay or gas to get there. This has affected both my physical and mental health.”

“I’ve had cancer 3 times in less than 4 years. First was breast cancer. When I received the bill for surgery, I immediately stopped the post-surgery radiation treatment before it was scheduled to stop because of my debt for the surgery.”

“I have cancer again and have chosen to not go through treatment again because I have had to choose between rent and food over medical care.”

Impacts of Cancer Related Medical Debt Are Unequal and Deepen Disparities

Black and Hispanic respondents are nearly twice as likely to report experiences such as being refused treatment by a provider they are indebted to (14% of Hispanic respondents compared to 8% non-Hispanic respondents indebted to a provider, and 13% of Black respondents compared to 7% of White respondents indebted to a provider). One-quarter of Hispanic respondents with cancer related medical debt say they have delayed or skipped medical care to avoid further debt, and they are twice as likely as non-Hispanics to report becoming ill due to not seeking care as a result of their medical debt (18% compared to 9% of non-Hispanic respondents with cancer-related medical debt). Black respondents with cancer-related medical debt are more likely to report being contacted by collections agencies (66% vs. 53% of White respondents with cancer debt) and more frequently report feeling harassed by debt collectors (44%, compared to 33% of White respondents with debt).

Help Paying for Treatment is Inconsistent and Leaves Many Dissatisfied—and Still in Debt

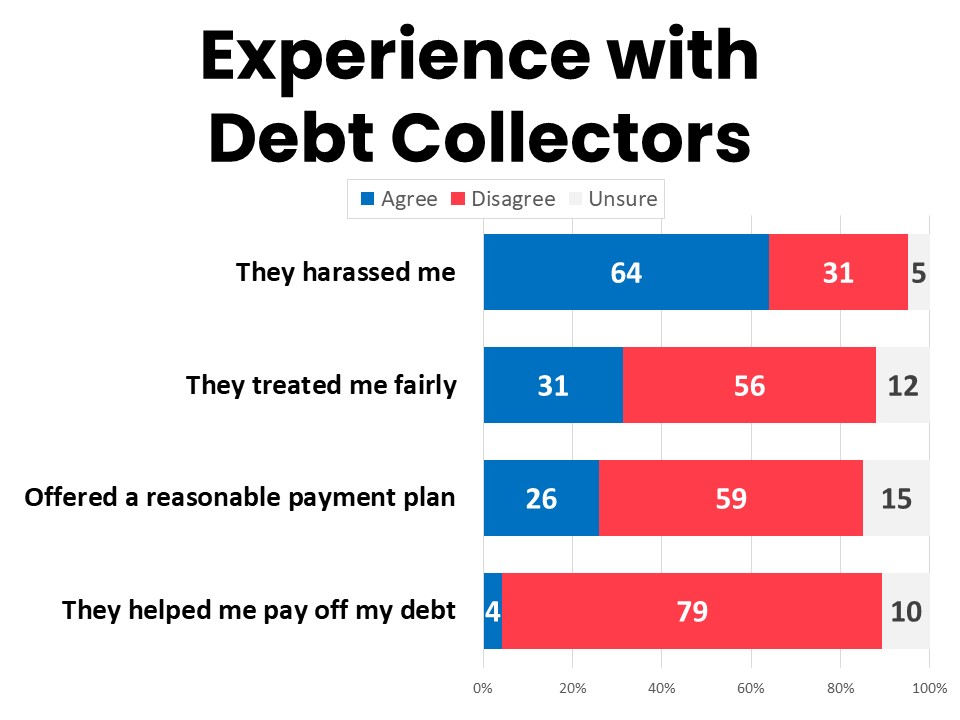

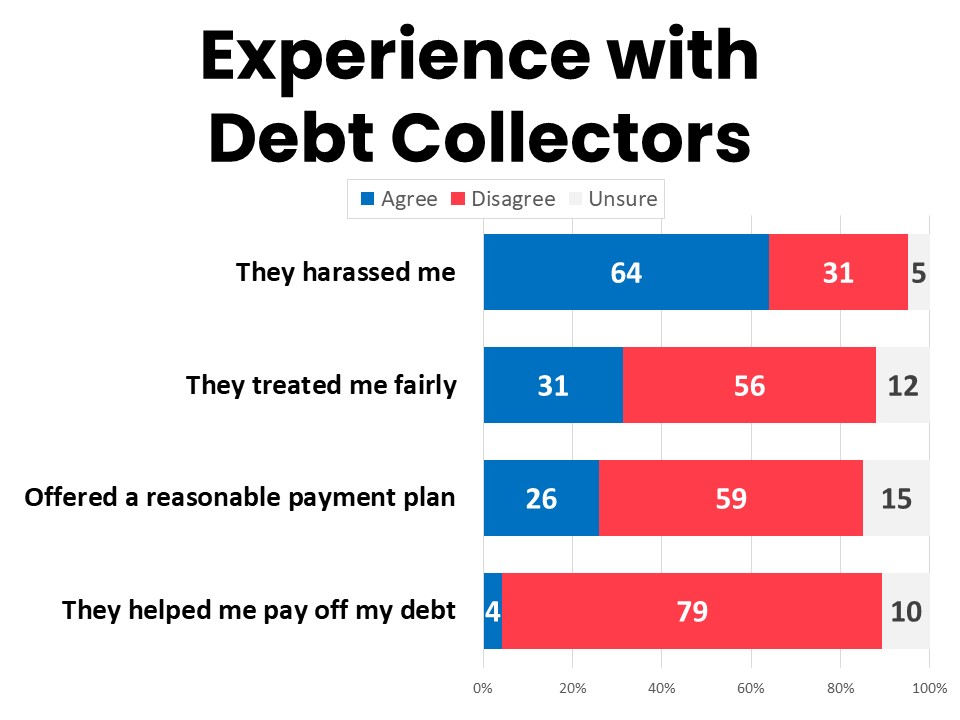

Fifty-five percent of those who have had cancer-related medical debt have been contacted by a collection agency or debt collector and 64% of those felt harassed. Just 31% believe they were treated fairly and only 26% say they were offered a reasonable payment plan. Only 4% say the debt collector or collections agency helped them pay off their debt, while 79% disagree that the collections process was helpful to paying off their debt.

Black respondents who have had cancer-related medical debt are more likely to have been contacted by a collections agency (66% compared to 53% of their White counterparts), are more likely to report that the amount of debt for which they were contacted was incorrect (15% compared to 8% of White respondents contacted by collections), and are more likely to report their credit score was impacted by their cancer-related debt (58% compared to 46% of White respondents with cancer medical debt).

While a majority of cancer patients and survivors surveyed (63%) are aware that most hospitals and many other health providers have financial assistance programs, one-quarter (25%) are not. Just over a third of those surveyed (36%) have been offered or applied for financial assistance and 68% of those successfully received it. Among the 468n who have been offered or applied for financial assistance, 41% were offered by the provider, 35% found out about it themselves, and 22% discovered it through another resource. Critically, among the 317n who were not aware of providers’ assistance programs, 30% said they would have changed something about their cancer treatment if they had known.

Over half (55%) of those who have had cancer-related medical debt have had a payment plan, medical credit card, or installment payments for their medical debt. These were also most often offered by the provider (48%), while 28% found them on their own and 9% discovered them from another resource. Only about half (51%) of those with these typers of debt products felt they clearly understood the terms, and 46% say they were able to make the payments. Fewer than half (45%) say they would use the product again, and 40% say it provided access to care they couldn’t otherwise have afforded. Just 31% say the payment plan, medical credit card, or installment payments were offered at a reasonable rate, while 26% say they were surprised by the rate or owed more than they thought and 24% report that it made their debt increase. More than half (56%) say they felt pressured into the loan product.

A Multifaceted Policy Approach Can Help Reduce Cancer-Related Medical Debt and Help Families Already Burdened by Medical Debt

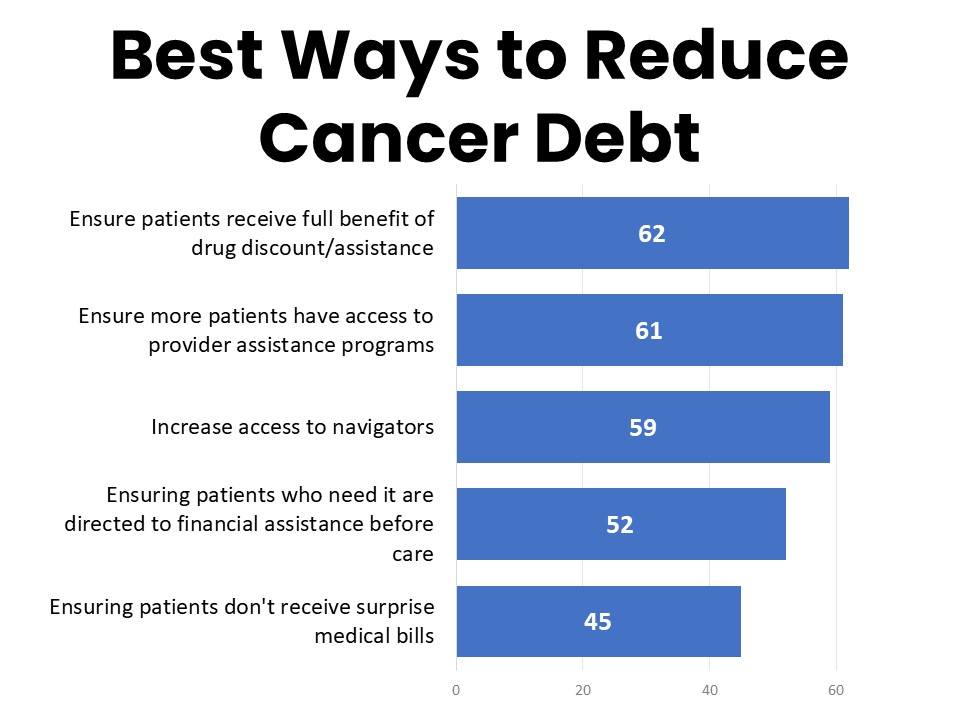

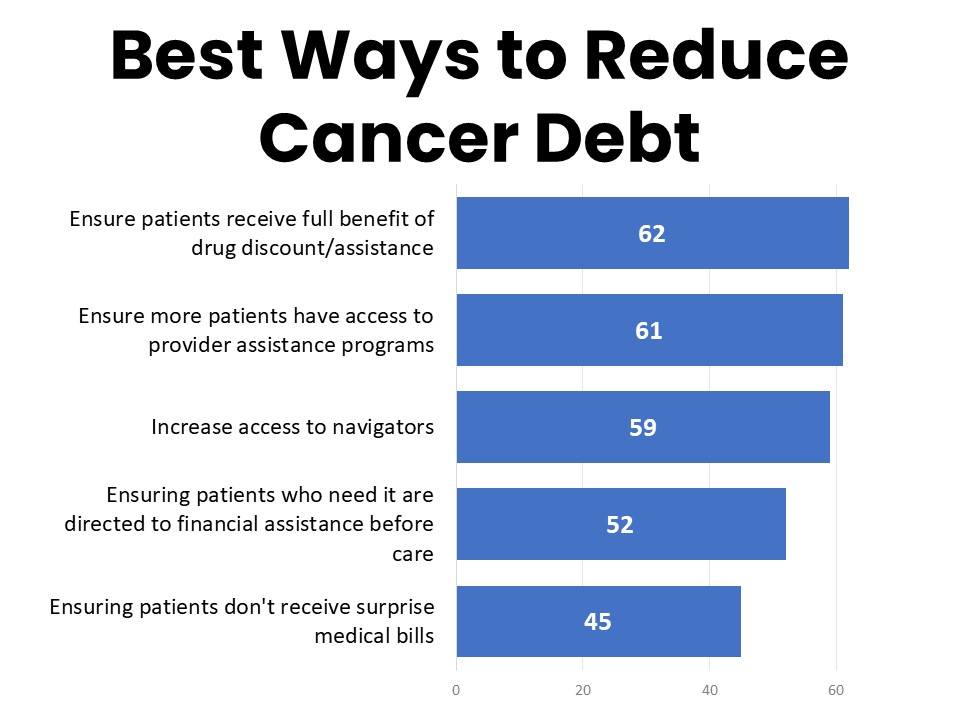

The survey tested five potential ways to help reduce the medical debt associated with cancer. Topping the list in terms of greatest perceived benefit are ensuring patients receive the full benefit of drug discount and assistance programs (62%), ensuring more patients have access to provider assistance programs (61%), and increasing access to patient navigators (59%). Ensuring that patients who need it are directed to financial assistance before they begin care is also seen by 52% as one of the most helpful ways to reduce medical debt associated with cancer, while 45% say ensuring patients don’t receive surprise medical bills would be most helpful.

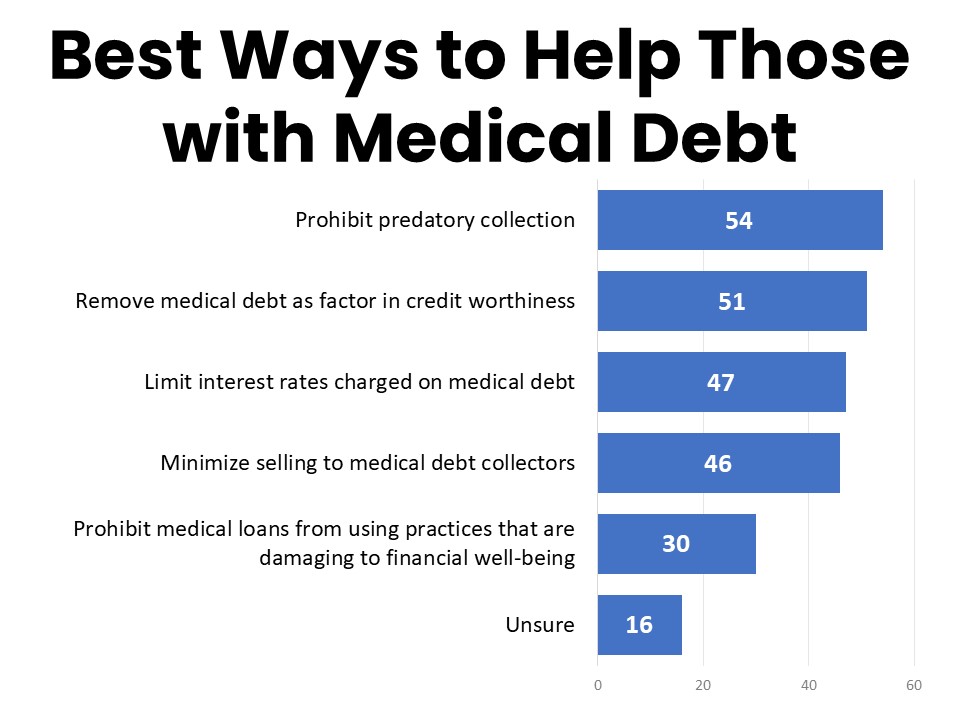

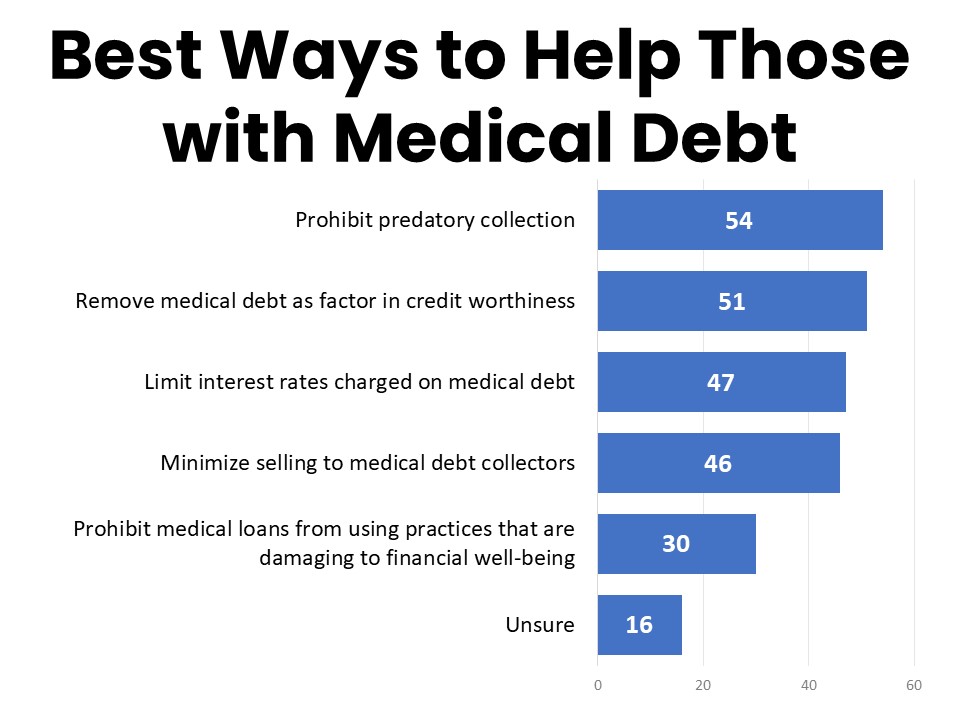

When it comes to helping families who are already facing medical debt, 54% agree that prohibiting predatory and discriminatory debt collection practices would be of greatest help, followed by 51% who consider removing medical debt as a factor in evaluating an individual’s creditworthiness as one of the most important ways to help. Limiting the interest rates charged on medical debt (47%) and minimizing sales of medical debt to medical debt collectors (46%) are also considered very helpful.

Methodology:

ACS CAN’s Survivor Views research initiative was designed to support the organization’s efforts to end suffering and death from cancer through public policy advocacy. Data provided by cancer patients and survivors as part of this project allows for a greater understanding of their experiences and opinions on cancer-related issues and gives voice to cancer patients and survivors in the shaping and advocating of public policies that help prevent, detect, and treat cancer and promote a more positive quality of life for those impacted.

To ensure the protection of all participants in this initiative all research protocols, questionnaires, and communications are reviewed by the Morehouse School of Medicine Institutional Review Board.

The survey population is comprised of individuals who meet the following criteria:

- Diagnosed with and/or treated for cancer within the last seven years

- Over the age of 18 (parents of childhood cancer survivors were invited to participate on behalf of their minor children)

- Reside in the US or US territories

Survivor Views participants are invited to participate through email, direct mail, social media, and outreach to communities and partners engaged with cancer patients and survivors. Those who agree to participate after reviewing the informed consent information complete the survey online, including demographic and cancer history information to inform analysis and topical questions as discussed in this document. The data were collected between March 18-April 14, 2024. A total of 1,284 cohort participants responded to the survey. Differences reported between groups are tested for statistical significance at a 95% confidence interval.

About ACS CAN

The American Cancer Society Cancer Action Network (ACS CAN) advocates for evidence-based public policies to reduce the cancer burden for everyone. We engage our volunteers across the country to make their voices heard by policymakers at every level of government. We believe everyone should have a fair and just opportunity to prevent, detect, treat, and survive cancer. Since 2001, as the American Cancer Society’s nonprofit, nonpartisan advocacy affiliate, ACS CAN has successfully advocated for billions of dollars in cancer research funding, expanded access to quality affordable health care, and advanced proven tobacco control measures. We stand with our volunteers, working to make cancer a top priority for policymakers in cities, states and our nation’s capital. Join the fight by visiting www.fightcancer.org.