The Costs of Cancer Survivorship - 2022

Introduction

The American Cancer Society defines the term “cancer survivor” as any person with a history of cancer, from the time of diagnosis through the remainder of their life. This report is intended to focus on the costs of cancer for those who have finished active treatment.

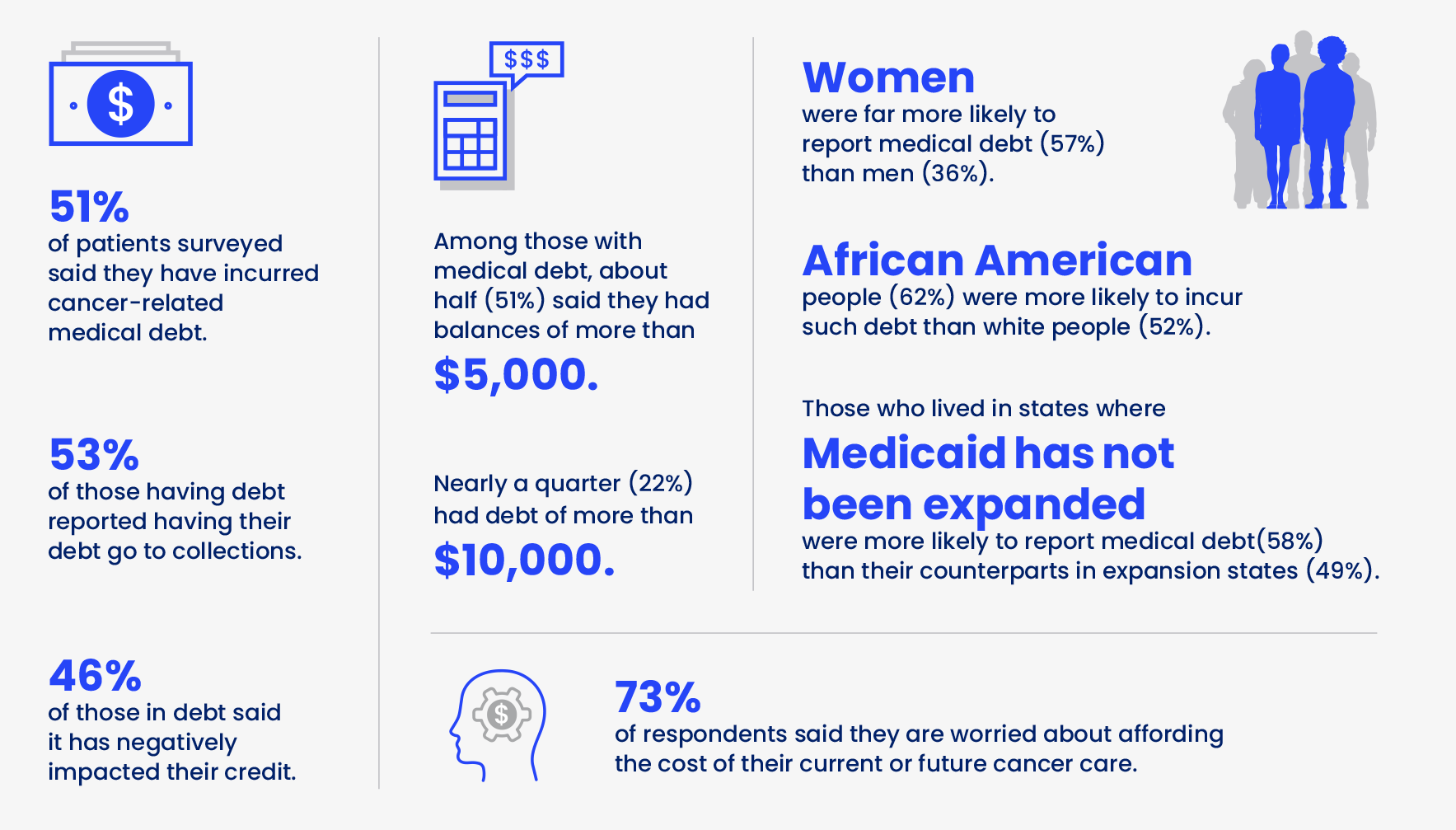

As new cancer treatments continue to become available and cancer deaths decline, the number of cancer survivors in this country increases each year. As of January 1, 2022, there were an estimated 18 million cancer survivors in the U.S.1 Many of these individuals will continue to be affected by their cancer or its treatment for months, years and decades after initial diagnosis and treatment. The costs of cancer – and the impact of these costs – do not end when active treatment ends. Individuals face ongoing financial impact. A 2022 American Cancer Society Cancer Action Network (ACS CAN) survey found that over half of cancer survivors report carrying medical debt from their cancer-related treatments.

Table of Contents

The Costs of Cancer Survivorship report explores the costs incurred specifically by survivors, including the costs of follow-up care and care for late and long-term effects of cancer, as well as the lasting financial impacts of high costs during their active treatment. The report includes cancer survivor profiles to illustrate these costs over the course of an insurance year.

Factors Contributing to the Ongoing Costs of Cancer for Survivors

The costs of cancer don’t end when a patient completes active cancer treatment. While expenditures for cancer treatment tend to be highest in the active/initial treatment and end-of- life phases of care,5, 6 cancer survivors who have finished their active treatment also experience higher out-of-pocket costs compared to individuals who have never been diagnosed with cancer.7 Cancer survivors continue to have higher health care costs after active treatment for several reasons, including:

- Maintenance treatment: Many cancer survivors take hormone therapy medication or receive other maintenance-type treatments for years after finishing active cancer treatment. These treatments often require a monthly copay or coinsurance that significantly increases a survivor’s out-of-pocket costs.

- Monitoring for disease progression or recurrence: Follow-up protocols for most cancer survivors includes regular office visits, laboratory work and/or imaging to monitor for recurrence of cancer. Most of these services will require copays or coinsurance and are an ongoing expense for several years into survivorship. Imaging tests can be particularly costly, especially for patients who are charged coinsurance (a percentage of the cost) versus a flat copay, or in cases where the insurance company disputes the need for the test – which is a common problem.

- Ongoing side effects from cancer treatment: Cancer treatment is often very hard on a patient’s body, and many individuals experience side effects – some serious – from treatment that persists in survivorship. Treatments for these side effects can be costly, especially those that involve various types of therapy. Therapy is often expensive for patients because they must receive this service daily or weekly, often paying cost sharing each time. Survivors also often have challenges finding a qualified provider who is in-network and close to their home or office, and therefore incur out-of-network costs and high travel expenses.

- Late and long-term effects: Many cancer survivors experience late and long-term effects caused by their cancer or cancer treatments that arise in survivorship. These may require treatment many years after their initial cancer diagnosis and can be major medical events in their own right (such as heart trouble), requiring the individual to take another significant financial hit. This is particularly a concern for survivors of pediatric and young adult cancers. One reason treating the long-term effects of cancer care can be so expensive is that the necessary treatments often come with frequent and high cost sharing or are excluded from coverage by insurance.

- Mental health treatment: Up to 50% of people with cancer experience depression,8 and the toll of cancer on a patient’s mental health does not stop when they finish active cancer treatment. Many cancer survivors benefit from ongoing mental health treatment – which is complicated by the significant gaps in coverage and other barriers to accessing mental health treatment in the U.S.9

- Secondary cancers: In some cases, being a survivor of one type of cancer puts the patient at higher risk for a different type of cancer – and guidelines recommend additional surveillance aimed at detecting new cancers early. Additionally, all cancer survivors continue to need regular cancer screening appropriate for their age and risk profile – potentially including regular screenings for breast, colorectal, cervical, prostate and/or lung cancer. While these screenings should be provided with no cost sharing to the patient, sometimes insurance companies do not consider these services to be preventive since the patient has a history of cancer. This can cause unexpected costs for the cancer survivor.

| Common Late and Long-Term Effects of Cancer | Examples of Treatment |

|---|---|

| Pain | Medication, cognitive behavioral therapy, acupuncture, multiple visits with primary care and/or specialist providers |

| Lymphedema (swelling due to lymph fluid) | Lymphedema therapy, compression garments/devices, surgery |

| Neuropathy (nerve problems) | Medication, occupational therapy, physical therapy, acupuncture |

| Cardiovascular disease (heart problems) | Medication, blood and imaging tests (for diagnosis and long-term monitoring), potential surgery, multiple visits with primary care and/ or specialist providers |

| Cognitive impairment (problems with memory, learning, concentrating, making decisions) | Cognitive rehabilitation, exercise, multiple visits with primary care and/or specialist providers |

| Depression and/or anxiety | Counseling, medication, psychoeducation, multiple visits with primary care and/or specialist providers |

| Impaired fertility (problems conceiving or carrying a baby full term) | Blood and imaging tests, medication, in vitro fertilization (IVF), multiple visits with primary care and/or specialist providers |

Note: this is not intended to be a comprehensive list. Please visit https://www.cancer.org/treatment/treatments-and-side-effects/physical-side-effects.html for more information about cancer related side effects.

Adequate insurance coverage continues to be vital for cancer survivors. The American Cancer Society and ACS CAN believe that every individual should have access to high-quality and affordable health insurance coverage, as this has been shown to increase access to cancer prevention and screening, and improve cancer outcomes.10 Having access to high-quality insurance coverage is especially important for cancer survivors, because, as explored above, most have ongoing cancer-related health needs, and having insurance increases their access to necessary care.

Prior to 2010, many cancer survivors faced challenges enrolling in health insurance because their cancer was considered a preexisting condition. Many health insurance plans – especially those purchased individually – would exclude coverage of care related to a survivor’s cancer, increase premiums because of their prior history, drop coverage when a person was diagnosed with cancer or outright reject the survivor’s application. This resulted in significantly higher costs for cancer survivors and poorer access to care.11

Fortunately, the Affordable Care Act (ACA) prohibited preexisting condition exclusions in most insurance plans starting in 2010,12 and this no longer is a barrier to care or cause of higher costs for most cancer survivors. However, preexisting conditions can still be excluded in certain types of plans that are not required to be ACA-compliant, like short-term limited duration plans. And even with ACA protections in place, some survivors face difficulties enrolling in, maintaining or affording the right insurance coverage during coverage transitions. Some people with cancer must leave their jobs or experience other changes in employment while they undergo active treatment, and these employment changes lead to transitions in insurance coverage to navigate during or after active treatment.

It is also imperative that cancer survivors are enrolled in insurance plans that are comprehensive and cover the services they need with cost sharing they can afford. While the ACA made significant progress in ensuring most plans available are adequate – like banning lifetime and annual benefit limits, establishing maximum out-of-pocket limits, requiring coverage of Essential Health Benefits in some plans and requiring coverage of preventive services with no cost sharing in most plans – there is much more work to be done. Over half (56.4%) of privately insured cancer survivors have a high deductible health plan,13 which requires many of these individuals to pay high up-front costs for medical treatment, including necessary cancer follow-up care. Additionally, survivors encounter services they need that are not covered by their insurance plan, like fertility preservation or treatment services, which are explored further in this report.

Cancer treatment costs leave many survivors in serious debt. The problem of ongoing cancer survivorship costs is compounded by the fact that many cancer survivors carry debt from the expenses of their active cancer treatment. The costs of surgeries, intense drug treatment, radiation treatments and frequent imaging tests can add up very quickly and overwhelm those diagnosed with cancer, including middle- to higher-income people. Many patients emerge from active treatment with direct medical debt – i.e., debt owed to a medical provider or facility – or other types of debt caused by their cancer – i.e., they have paid some medical bills with a credit card, or they owe debts to utility providers or landlords as they were unable to pay bills while undergoing and paying for cancer treatment.

While there are some new protections for individuals carrying certain types of medical debt,14 it continues to be a huge problem for many cancer survivors – one that impacts the financial well-being of their entire family for decades. Medical debt impacts people of color more than white individuals in the U.S.15 Black households carry medical debt disproportionately compared to other groups with 1 in 3 Black adults having past-due medical bills, compared to fewer than 1 in 4 white adults.16 People of color not only carry more medical debt, but they also are pursued by debt collectors more aggressively for their debt, which increases health disparities already present in this population.

Everything else doesn’t stop when you hear the words “you have cancer.” The electric bill still comes every month, so you have to choose what bills to pay while knowing you will probably never get ahead. KATHY KEITH

Breast Cancer Survivor

Survivor Story

Survivor Story

Kathy Keith, 55, was first diagnosed with breast cancer in 2013 and later with metastatic breast cancer that spread to her bones in 2015. She has undergone continuous treatments since then, including numerous surgeries and chemotherapy regimens, and is currently on an intravenous chemotherapy.

Kathy’s husband also has cancer. He was diagnosed with throat and tongue cancer in 2018. His chemotherapy resulted in the removal of his teeth and the need for a feeding tube. He has been unable to work for the past five years and in 2020 qualified for Medicare health coverage. However, Medicare will not cover the cost of his dental implants, which will total almost $30,000.

Kathy, who works as a legal assistant, has never stopped working during her cancer treatment.

She currently has coverage through the marketplace. However, her coverage has been periodically interrupted as she’s had to change jobs during the course of the COVID-19 pandemic. Her premium is currently $629 a month, with an $4,000 deductible and $13,000 out-of-pocket maximum.

Combined, the couple has incurred about $50,000 in medical debt throughout the years of their cancer care. They have had to file for bankruptcy.

The couple has stopped doing things they enjoy, like playing miniature golf, and are living “...paycheck to paycheck, and some bills don’t get paid until they absolutely have to be paid. We pay what we can, but it is never enough to get out of debt.”

Cancer Survivor Views on Medical Debt

In February 2022, ACS CAN asked people with cancer and survivors about their experiences with medical debt through a Survivor Views survey.

Without health insurance the Emergency Room is [my daughter’s] only source of health care. But there, all they do is patch her up and send her out the door - only to come back when she has another flare-up. Her medical costs have bankrupted me once and could again. However, I cannot just turn away and ignore the very real needs she still has.

RENEE HENRY

Caregiver

Survivor Story

Survivor Story

Renee Henry is the mother of a childhood cancer survivor. Her daughter, Misti, was 3 when she was diagnosed with acute lymphoblastic leukemia (ALL) in 1983. She underwent three years of intense and traumatic treatments that have resulted in a number of serious, long-term side effects that continue to this day, including degenerative disc disease, complex post- traumatic stress disorder and long-term mental health problems. Pain from Misti’s numerous surgeries resulted in her developing substance addiction problems, which necessitated numerous in-patient rehabilitation programs.

Because Misti lives in North Carolina – one of 11 states that has yet to expand Medicaid – she falls into the Medicaid coverage gap and has been unable to get health coverage. Renee has therefore remained financially responsible for much of Misti’s care and has had to file bankruptcy due to medical debt. She is still paying out-of-pocket copays that range from $125 to $375 so Misti can continue to receive health care. The hospital charges $125 for her to be seen, and then additional fees for any scans, tests or other procedures.

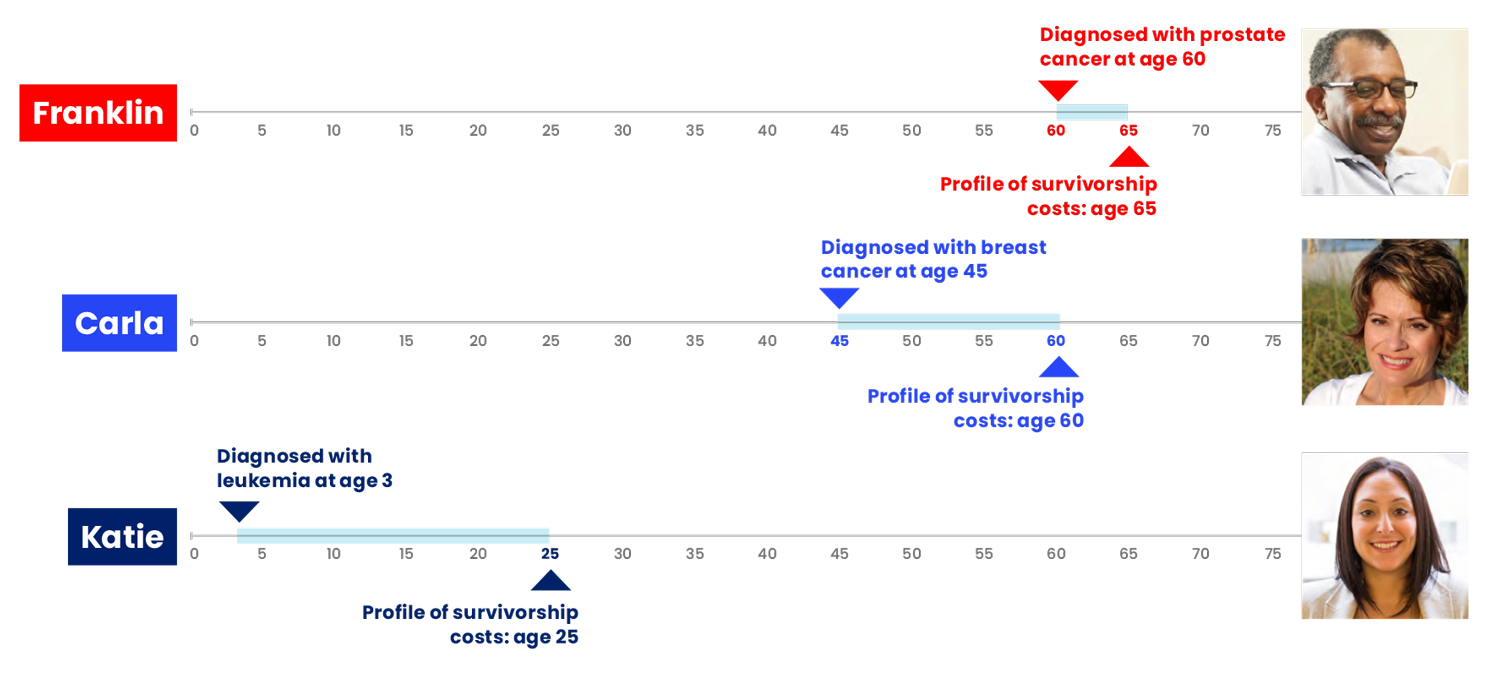

Survivor Profiles: Cost Scenarios

Because of the complexity and variation in cancers and their treatment, it is difficult to predict the total expenses for any individual’s course of cancer treatment, or their costs in survivorship. The following survivor profiles and associated data represent the typical costs for several cancer survivorship scenarios that include possible long-term effects following active treatment.

The survivor profiles are hypothetical, but the treatment and clinical profiles are typical for each specific cancer identified. The costs in each profile are based on the real modeled costs for the services indicated.

Experts at the American Cancer Society and ACS CAN constructed profiles of several typical cancer survivors. The types, stages, details of cancer and late and long-term effects were chosen based on cancer incidence rates and the desire to represent a diverse set of cancer survivors and experiences. The courses of active treatment for Franklin and Carla were profiled in The Costs of Cancer 2020 report,17 while Katie’s profile was created for the 2022 report. Clinical experts determined the course of treatment for these survivors in consultation with the American Cancer Society/American Society of Clinical Oncology Breast Cancer Survivorship Care Guideline,18 the American Cancer Society Prostate Cancer Survivorship Care Guidelines19 and the Children’s Oncology Group’s Long-Term Follow-Up Guidelines for Survivors of Childhood, Adolescent, and Young Adult Cancers.20

Estimates for out-of-pocket costs for each of these survivors were based on common insurance scenarios. Survivor profiles were used to run multiple insurance scenarios for comparison and analysis purposes; combinations of profiles and insurance design scenarios that are not reflected in this section will be discussed in future sections. All prices and insurance designs are based on 2022 data and plan years.

These profiles represent typical scenarios and timelines. They help illustrate the expenses that cancer survivors and health care payers incur for an individual’s cancer-related survivorship treatments. Note that, except where explicitly stated otherwise, these scenarios do not include costs for other health care treatments unrelated to cancer. Also note that these scenarios are unable to incorporate all the problems cancer survivors face, including tests that have to be repeated and delayed timelines.

Survivor Profile

Carla, Breast Cancer Survivor

Carla was diagnosed with stage III breast cancer (hormone receptor negative, HER2 positive) at age 45. Her cancer treatment consisted of neoadjuvant chemotherapy, which shrunk her tumors but did not fully eliminate them. She then had surgery (local excision and lymphadenectomy), followed by radiation treatments. After this, she received one full year of anti-HER2 plus chemotherapy. Since Carla still has most of her breast tissue, she must have a mammogram every year to look for cancer recurrence.

In January 2022, at age 60, Carla made an appointment with her primary care physician (PCP) because she was experiencing shortness of breath, fatigue and swelling of the legs. Her PCP performed a physical examination and referred her to a cardiologist.

Carla’s cardiologist ordered a chest x-ray, ECG and bloodwork. Following assessment of these tests, and after reviewing her medical history (such as prior treatment with a particular chemotherapy drug), her cardiologist diagnosed her with stage C heart failure, likely resulting from her cancer treatments. Then, Carla underwent a cardiac stress test, which revealed atherosclerotic heart disease. She also underwent catheterization to assess the extent of this condition.

Carla’s cardiologist started her on a regimen of multiple prescription medications in January and February. She saw her cardiologist monthly after that so they could assess progress, adjust dosages and run blood tests. Once Carla and her doctor were confident with her treatment regimen, she changed her cardiologist visits and labwork to every two months and continued treatment through the end of the year. Carla is likely to continue needing these or other treatments for her heart failure for the rest of her life.

Carla’s Costs

Carla is enrolled in her large employer’s health plan. She does not pay anything toward her premiums. Her employer covers this cost.

Carla’s out-of-pocket costs were highest in the first month of the year, when she underwent several tests and diagnostic procedures. Since her employer plan does not have a medical deductible, she pays copays or coinsurance for all her treatments. While Carla’s costs in this insurance plan are relatively low compared to other plans, her costs are still front-loaded to the first month of the year, which she might find difficult to afford. At the end of her plan year, she had paid a total of $2,679 in cost sharing for her cancer-related survivorship care.

The costs for Carla’s cancer survivorship-related treatments are likely only part of her overall health care costs. Costs for services unrelated to her cancer are not included in this scenario and would likely add to her financial burden every year.

Costs for an uninsured patient may be higher than this estimate because uninsured patients do not benefit from a plan’s negotiated discount rate. However, some uninsured patients are also able to receive charity care, which discounts or forgives certain treatment costs – but is not an adequate safety net for the uninsured.

Survivor Profile

Franklin, Prostate Cancer Survivor

Franklin was diagnosed with locally advanced prostate cancer at age 60. His cancer treatments included hormone (ADT) and radiation therapy. After several months of first-line treatment, his PSA levels had risen, and he moved on to a successful second-line hormone therapy. Five years later, at age 65, Franklin continues active surveillance for his prostate cancer. He scheduled an appointment in January with his primary care physician (PCP) as he was experiencing signs and symptoms of erectile dysfunction. The PCP discussed his medical history, performed a physical examination and ordered labwork. Upon reviewing these results, the PCP diagnosed Franklin with erectile dysfunction, which is a common long-term effect of prostate cancer and its treatment.

Franklin was given a prescription for medication to use as needed to treat his erectile dysfunction. After several failed attempts with this medication, the PCP increased his dose. After additional failed attempts over the next month, the PCP referred him to a urologist. In March he visited the urologist, who ordered additional lab tests. After reviewing Franklin’s labwork and medical history, the urologist prescribed second-line therapy, which included an intraurethral suppository and vacuum device.

Franklin had success and continued this treatment through the end of the year. In December he had his normal annual physical with his PCP, when he once again had blood drawn for routine tests.

Franklin’s Costs

Franklin has health insurance coverage through Medicare and Medigap. He pays $390 per month in premiums for his Part B, Medigap and Part D (drug) coverage – a total of $4,679 for the year. Franklin’s highest out-of-pocket spending came in January as he visited multiple doctors and underwent bloodwork as part of his erectile dysfunction diagnosis.

After the initial diagnosis, his costs mostly evened out month-to-month, but he did have to pay $328 per month for his medications all year because Medicare does not cover treatments for erectile dysfunction even when they are caused by cancer. At the end of his plan year, he had paid a total of $4,242 out of pocket: $233 in cost sharing for covered services, and $4,009 for uncovered services.

Franklin will likely continue to need these treatments to address his sexual dysfunction in future years, which will add to his long-term medical costs. The costs for Franklin’s cancer survivorship-related treatments are likely only part of his overall health care costs. Costs for services unrelated to his cancer are not included in this scenario and would likely add to his financial burden every year.

Survivor Profile

Katie, Childhood Leukemia Survivor

Katie was diagnosed with pediatric B-precursor acute lymphoblastic leukemia (ALL) at age 3. Her treatment included several different chemotherapy regimens. After three-plus years of these treatments, her ALL went into remission. Katie continued to see her pediatric oncologist and neurologist once a year for routine checkups.

Katie, now 25, continues these annual visits each January, which also include standard blood tests to monitor for cancer recurrence. While her checkup went well this year, Katie also is ready to start a family but is having trouble conceiving.

She made an appointment to see her OB/GYN for her regular cervical cancer screening, and to ask about her challenges conceiving. The OB/GYN ran fertility-related blood tests and found Katie had diminished ovarian reserve and an irregular menstrual cycle. Fertility problems like these are common late-term effects of childhood cancer treatment. Katie’s OB/GYN referred her to a fertility specialist in January. The fertility specialist ordered bloodwork, conducted an ultrasound and prescribed a regimen of medications Katie injected at home on a specific schedule. Part of this regimen included specifically timed ultrasounds and an intrauterine insemination procedure at her fertility specialist’s office. After two months, Katie was still not pregnant.

In April, the fertility specialist recommended in vitro fertilization (IVF) as Katie’s next step. Her fertility specialist performed ovarian reserve testing, semen analysis and HIV screening before starting her IVF process. To start ovulation induction, Katie was placed on another regimen of self-injected medications. Then, she visited her fertility specialist for an ultrasound and blood test to determine if her eggs were ready for collection. Thirty-six hours after the final injection and before ovulation, the infertility specialist used transvaginal ultrasound aspiration to retrieve Katie’s eggs. After five days, she visited her fertility specialist for embryo transfer. After two weeks, her fertility specialist performed a blood test for pregnancy, which was negative.

Katie went through two more cycles of IVF treatment. Her third cycle of treatment was successful, and she became pregnant in November.

Katie’s Costs

Katie bought an individual health insurance plan through her state’s marketplace, which started in January. The premium for the plan was $214 per month, but she qualified for tax credits, which helped reduce these costs. Katie ended up paying $159 per month in premiums.

While Katie’s premiums may have been affordable, her out-of-pocket costs were very high because her plan does not cover fertility treatments – even though her need for these treatments was likely caused by her cancer treatments. By the end of her plan year, she had paid $83,475 for services not covered by her insurance plan, and $432 in cost sharing for covered services – for a total of $83,907.

The costs for Katie’s cancer survivorship-related treatments are likely only part of her overall health care costs. Costs for services unrelated to her cancer are not included in this scenario and would likely add to her financial burden every year.

Data Analysis & Key Findings

Having Comprehensive Insurance Coverage Is Critical for Cancer Survivors

In most scenarios, including Franklin’s and Carla’s scenarios presented in this report, cancer survivors paid a considerable sum out of pocket for their care but would have paid significantly higher amounts if they had been uninsured.

The type and features of insurance coverage a cancer survivor has are important factors in how much they pay out of pocket. Premiums, deductibles, copays and coinsurance and the costs of uncovered services must all be considered. The graph below shows how Carla’s costs vary depending on her insurance plan. Key findings from her scenario include:

- Carla has the highest annual costs when she is enrolled in a small employer plan: she pays a high deductible ($6,000), while also paying almost $4,000 in premiums annually.

- Carla has the lowest annual costs when she is enrolled in a large employer plan: she pays no premiums and no deductible, but still pays what most people would consider a significant amount of cost sharing ($2,679).

- In the plans for which she pays significant premiums, Carla does not necessarily “get what she pays for” in lower cost sharing. Many people believe if they choose a plan with high premiums, they will not have to pay other costs throughout the year. That is often not the case, as most plans involve cost sharing for most non-preventive treatments, and most individuals with a history of cancer use many health care services per year.

Survivors’ Out-of-Pocket Costs Vary Widely

Breast Cancer Survivor’s Costs with Various Plans

Coverage Transitions Can Be Challenging for Cancer Survivors

Because many cancer survivors have ongoing health needs, it is crucial that they maintain health insurance coverage. However, job and life changes can make this challenging for them. Katie, who survived pediatric blood cancer, continues to need follow-up care even 20 years after her diagnosis. She stayed on her parents’ insurance plan as a young adult to continue receiving care, but when she turned 26 the plan was no longer required to offer her coverage and she had to find a new plan. She is particularly vulnerable to seeing higher costs during this insurance transition and multiple spikes in her spending patterns, which can make health care unaffordable. If a cancer survivor must change insurance coverage midyear, they will likely be required to pay the new plan’s deductible and maximum out-of-pocket amount, regardless of whether they have paid these amounts under their previous insurance. Higher costs also may result from the new plan covering different benefits and/or providers.

Katie had to change plans because she aged off her parents’ insurance plan, which can be a real challenge for adult survivors of childhood cancer. Other cancer survivors may have to change insurance plans midyear because they changed/lost their job, moved to part time or moved to a new state or area to access specialized care or live with a caregiver. One study found that in 2018, over 250,000 cancer survivors with health insurance coverage in the U.S. experienced a disruption in their insurance coverage in the past 12 months.21

I'm at the point in my life where my friends are buying houses, starting families and getting married, but I’ve emptied my savings to pay for my health care. It’s hard. Filling up my tank has gone up at least $25-$30 every time I fill it and adding that to these already exorbitant monthly costs. And food – something you don’t think about in terms of cancer survivors and the importance of eating healthy and nutritious foods – that’s where the prices are really going up. I rely on couponing and weekly sales to figure out what my meal plan is going to be for a week. It is not like I’m able to go and just free plan these things anymore.

ALIQUE TOPALIAN

Acute Myeloid Leukemia Survivor

Survivor Story

Survivor Story

Alique Topalian, 28, was first diagnosed with acute myeloid leukemia (AML) when she was just 4 years old. The diagnosis set the trajectory for the rest of her life, including being the source for her desire to seek a master’s degree in public health and a PhD in health promotion.

In March 2021, not long after completing her PhD, Alique’s cancer returned – something unheard of after more than 20 years in remission. She was hospitalized for six months while undergoing intense chemotherapy. Because Alique was unable to work and meet expenses and because she needed a caregiver, she moved back in with her mother in Cleveland. She was out of work for a full year and had to fight for disability income until she was able to return to work full time in March 2022.

Unable to find an appropriate bone marrow match, Alique cannot have a bone marrow transplant and instead is enduring maintenance chemotherapy every two weeks for the next three to five years. She qualifies for a prescription assistance program to afford what would otherwise be a $3,000 a month copay for one of her oral chemotherapy drugs, but she estimates she still spends at least 30% of her $55,000 annual income on drugs and doctor’s visits.

Now back in Cincinnati and renting a home with her partner, Alique’s health care costs are being compounded by the rising cost of gas, food and other cancer-related needs.

Alique is currently negotiating a payment plan with the hospital to try and cover several thousand dollars in outstanding medical bills.

Finding Affordable Options Can Be Challenging for Cancer Survivors

As a young adult cancer survivor, it is critical that Katie has comprehensive health insurance. But even among comprehensive plans, her out-of-pocket costs for covered services varies widely.

- The Medicaid expansion plan requires the smallest amount of out-of-pocket expenses, but Katie would only qualify for this coverage if her income was very limited. Additionally, if she lives in one of the 11 states that has not expanded Medicaid to all adults earning up to 138% FPL, she would not likely qualify for a Medicaid plan as a “childless” adult.

- While Katie pays smaller premiums for her short-term limited duration insurance (STLDI) plan, it is not comprehensive coverage. In fact, this plan does not pay for any of the health care Katie needs during the year, including services that the other plans do cover, like visits with her primary care and cancer doctors and her yearly cancer screenings. STLDI plans are individual health insurance policies originally intended as temporary coverage. These plans are exempt from the patient protections consumers are accustomed to in the individual market.

- The individual marketplace plan is a comprehensive plan for which Katie receives subsidies in order to make the plan more affordable. This plan covers all of her non-fertility-related services, though she does have to pay for certain covered services in full because her deductible applies.

Survivors’ Out-of-Pocket Costs Vary Widely

Young Adult Blood Cancer Survivor’s Costs with Various Plans

Cancer Survivors Can Have Uncovered Costs

Katie’s ability to conceive children may have been impacted by her cancer treatments. Many survivors of childhood or young adult cancers who want to conceive need fertility preservation or fertility treatments. A recent study estimated that 68.8% of adolescent or young adult people with cancer would need fertility preservation care – a number that amounts to over 85,000 men and women.22 Unfortunately, none of the plans available to Katie cover fertility services, which is a common – and very expensive – problem for some cancer survivors.

In each insurance scenario, Katie must pay over $75,000 for her fertility treatments because they are not covered by her insurance plan. (See the blue color bars in graph above.) These uncovered costs include the services that led up to her diagnosis and treatments that preceded the IVF procedures – compounding the high-cost burden.

Some states have passed laws requiring certain insurance plans to cover fertility preservation services for people with cancer and survivors. Katie and her family would likely have benefited from such a law. Other common services needed by cancer survivors that are not covered by medical insurance include the costs of wigs and prostheses, treatments for sexual dysfunction (as exemplified in Franklin’s profile), mental health services, dental services, nutrition and dietary support, acupuncture and other integrative services and ostomy and other home care supplies.

Many Cancer Survivors Have Other Conditions That Contribute to Their Costs

While cancer treatment often represents an incredibly intense and defining episode of medical care in a patient’s life, most individuals diagnosed with and having survived cancer will also need medical treatment for other conditions over the course of their life. This is especially true as cancer survivors age and comorbidities increase. The costs a survivor pays for cancer-related services are very unlikely to be the only health care costs that they will be paying.

To illustrate the impact of additional conditions on a cancer survivor’s spending, we analyzed the costs of care for Franklin if, in addition to his treatment related to prostate cancer, he also had Type II diabetes. Adding treatment for Type II diabetes to Franklin’s profile significantly increased his out-of- pocket costs, as well as the overall health care expenditures for his care.

Comorbidities Increase Costs for Cancer Survivors

Annual Out-of-Pocket and Overall Expenditures for Franklin, Prostate Cancer Survivor

*Note the out-of-pocket costs reflected in this graph include premiums.

Out-of-Pocket Caps Help Make Cancer Survivorship Care More Affordable

Since the passage of the Affordable Care Act, most private insurance plans are required to have a maximum out-of-pocket cap for covered in-network services. This sets a federal maximum for the amount a patient would have to pay for covered in-network services in a given year. If they incur a large amount of expenses in that year, like the many expenses associated with cancer treatment, the out-of-pocket cap protects them from having even higher costs and creates some predictability in budgeting for health care expenses. However, for enrollees in traditional Medicare coverage, there is no cap on out-of-pocket expenses, and therefore they are left unprotected from catastrophic costs.

Federally Required Out-of-Pocket Caps

Consequently, people with cancer and survivors enrolled in Medicare are left vulnerable to unlimited spending – especially those enrollees who do not have Medigap plans. Below is an illustration of Carla’s out-of-pocket spending as Medicare is currently structured compared to her spending with a Part D cap – to be implemented starting in 2025. With this cap, Carla would save $714 in the year we analyzed.

An Out-of-Pocket Cap in Medicare Part D Will Make Cancer Survivorship Care More Affordable

Monthly Out-of-Pocket Costs for Carla, Breast Cancer Survivor

Congress enacted a $2,000 Part D out-of-pocket cap on Part D costs as part of the Inflation Reduction Act. The cap will be implemented starting in 2025. This cap does not apply to Medicare Parts A or B, and out-of-pocket spending for these services is still unlimited.

There Are Many Drivers of the Costs of Cancer Survivorship

Type of cancer, treatment plan and needs in survivorship cause huge variation in the source of cancer survivorship costs.

For all the survivors included in our analysis, the largest driver of costs was prescription drugs. Outpatient procedures, doctor’s visits and imaging tests also drove a significant amount of costs for some of the survivors. Note that in our Costs of Cancer 2020 report’s analysis of people with cancer being actively treated for their cancer, radiation treatments and surgery/hospital inpatient costs were identified as large cost drivers;23 while the cancer survivors in this analysis did not have any costs in these categories, as these are services more associated with active cancer treatment.

The Drivers of Cancer Survivorship Costs Vary Widely Among Survivors

Because of the debt from my cancer treatment, I can’t move forward. I feel like I’m standing still in time, but the years keep moving forward. I have a lot of shame from getting cancer and having to file for bankruptcy. I feel like I did all the right things and still got breast cancer. The debt compounds the shame. I was never in debt before I got cancer, but once I started treatment I didn’t have the money to pay the bills. Yet, I needed the treatment. The issues and problems associated with my breast cancer have left a heavy burden on my shoulders.

BARBARA BOWERS

Breast Cancer Survivor

Survivor Story

Survivor Story

Barbara Bowers started treatment for her breast cancer in 2008 in Tallahassee, Florida. Before her cancer diagnosis, Barbara was healthy, exercised, ate right and got her regular mammograms – but then her cancer treatment turned her life upside down. Now, as a cancer survivor, Barbara shares how she wishes she’d had more resources to help her navigate the costly and bumpy road of her cancer journey.

Barbara filed for bankruptcy in 2014 and still owes about $38,000 from her cancer treatment. Her treatment involved two surgeries, chemotherapy, radiation and a blood transfusion. Barbara had health insurance coverage with a $20,000 deductible and additional copays from her surgeon and oncologist, as well as radiation and medication costs. For the first time in her life, she got behind on her rent, utilities and other bills. Today Barbara is still paying off her medical debt to clear up her credit score so that she can purchase a house or a car. Her medical debt has significantly impacted her credit score and has resulted in calls from collection agencies, as well as her being denied credit cards due to the bankruptcy.

Policy Solutions to Address the Costs of Cancer Survivorship

Each of the scenarios included in this report illustrates that the expenses associated with cancer don’t stop when the initial treatment ends. Public policies designed to make cancer care available and affordable must also address the unique needs of cancer survivors.

ACS CAN views the affordability of cancer care and survivorship care as a multifaceted problem that requires multifaceted solutions.

ACS CAN advocates for public policies that address the individual and systemic costs of cancer by:

- Ensuring access to affordable and adequate insurance coverage for all that provides coverage for the services people with cancer and survivors need

- Limiting costs by preventing cancer and detecting it early through the use of screening and preventive services

- Reducing the overall financial impact of cancer for patients and their families

A comprehensive discussion of these policy approaches is included in the Costs of Cancer 2020 report.23 Many of these policies benefit cancer survivors, including ensuring access to affordable insurance coverage for all, ensuring access to health care services that survivors need and reducing the overall financial impact of cancer. Since the publication of our 2020 report, policymakers have made several improvements that address the costs of cancer and benefit cancer survivors, including:

- Expanding the subsidies available for purchasing insurance through marketplaces, which gives cancer survivors important access to comprehensive insurance for survivorship and other care. These expanded subsidies have been renewed through 2025 but need to be made permanent.

- Creating a $2,000 cap on out-of-pocket spending in Medicare Part D, which will be implemented in 2025. Part D plans will also be required to give beneficiaries the option of spreading their out-of- pocket costs out evenly from month-to-month, which helps them afford and plan for their health care costs.

- Expanding Medicaid in additional states (Oklahoma and Missouri in 2021, and South Dakota passed via ballot initiative in 2022), giving low-income cancer survivors access to necessary care. The majority of individuals still in the Medicaid coverage gap are people of color.24

- Passing and implementing the No Surprises Act, which protects patients and survivors from receiving surprise medical bills

While we celebrate these wins for people with cancer and survivors, we urge policymakers to do more to specifically address the costs of cancer survivorship.

ACS CAN priorities in this area:

Eliminate preexisting condition exclusions in all health insurance coverage. Prior to the Affordable Care Act (ACA), many private insurance plans discriminated against cancer survivors and those with other conditions by refusing to cover services related to their preexisting condition, increasing premiums because of these preexisting conditions or refusing to allow enrollment in the plan. Cancer survivors who did not have a guaranteed source of health insurance through public programs or their employer were often left to pay unaffordable premiums, try their luck with high-risk pools or remain uninsured, despite needing survivorship and other medical care.25

While the ACA prohibited these practices in most plans, there are still some types of insurance, or insurance-like products, that can exclude preexisting conditions. This includes short-term limited- duration insurance (STLDI) plans, health care sharing ministries and plans that were “grandfathered” into the ACA, meaning health plans that were already in effect prior to the ACA. ACS CAN urges policymakers at federal and state levels to prohibit the sale or limit the availability of these types of plans.

In particular, we urge immediate action regarding STLDI plans, which as exemplified in this report and other sources26 do not serve cancer survivors well. Since the previous administration expanded access to STLDI plans in 2018, there has been a significant increase in the availability and coverage length for STLDI plans.27 This can be confusing to consumers who may mistake these plans for comprehensive ACA-compliant coverage. ACS CAN urges the Biden administration to rescind the 2018 rule and strictly limit or prohibit the sale of noncomprehensive health insurance plans. Policymakers at the state and federal levels should also consider requiring these noncomprehensive plans to follow the same rules that ACA-compliant plans must follow or placing restrictions on their sale, marketing and length of availability.

Survivor Story

Survivor Story

When Laura Rodriquez was 10 weeks pregnant in February 2019, she felt pain and a lump in her left breast. She knew that breast tenderness is common during pregnancy, but she could tell something was wrong and wanted to get it checked out. At the time, Laura was working as a dental assistant and in school to become a respiratory therapist and did not have access to private or employer-sponsored health insurance. Fortunately, Oklahoma offers low-income pregnant women Medicaid coverage, which allowed her to quickly get screened for breast cancer, discovering she had three tumors. Laura’s cancer was aggressive and spreading quickly, and months later she had to have a mastectomy and began the first of four rounds of chemotherapy.

All the while she maintained a healthy pregnancy and later gave birth to a healthy baby boy named Jaxson.

One week after giving birth, Laura had to go back to work, and had to shift her focus to her own health. No longer pregnant, she was able to get the full recommended cancer treatment. And because some Oklahomans with breast cancer with low incomes are eligible for Medicaid, she was able to maintain her coverage even after giving birth. By February 2020, she was told that she was cancer-free. The Breast and Cervical Cancer Treatment Program saved her life while keeping her care accessible and affordable.

Take steps to prevent medical debt and address its impact on cancer survivors. Medical debt and the problems it causes are common among individuals with a cancer history. A 2016 study found that one-third of cancer survivors ages 18-64 years had medical debt, and 55% of those owed more than $10,000.28 A 2018 study found that 38% of the survivors age 50 or older were financially insolvent four years after their diagnosis.29 Cancer survivors are significantly less likely to be homeowners and more likely to have negative net worth than those without a history of cancer.30 Lastly, a study in Washington state found that a cancer diagnosis made individuals nearly three times more likely to go bankrupt.31 Not surprisingly, medical debt impacts cancer survivors in many ways: one study showed that survivors who incurred $10,000 or more in debt were significantly more likely to report social and economic impacts, including housing concerns and strained relationships.32 As discussed elsewhere in this report, ACS CAN’s own survey data show that roughly half of cancer survivors surveyed carried cancer-related medical debt, and African American respondents were more likely than whites to incur such debt, which deepens existing health disparities.33

To prevent medical debt and address its impact on cancer survivors, ACS CAN urges policymakers to:

-

Ensure all individuals have access to quality and affordable health insurance coverage so that if a

patient is diagnosed with a serious illness like cancer, they are less likely to fall into medical debt.

- Health insurance options must be available to all individuals with affordable premiums and comprehensive benefits.

- Cost sharing (including deductibles, copays and coinsurance) must be affordable for individuals enrolled in health insurance coverage.

-

Require health care providers to help people with cancer avoid incurring large amounts of medical

debt, including:

- Directing patients to available financial assistance programs

- Making financial assistance programs available to more low- and middle-income patients

- Ensuring payment plans or financial products offered to patients to pay medical bills are not predatory

- Ensuring billing practices conform with the No Surprises Act and are not predatory

- Require coverage of patient navigation services, particularly in Medicare and Medicaid, that include directing patients to available financial assistance programs.

-

Reduce the impact of already-incurred medical debt has on individuals’ lives, including enacting

policies that:

- Remove the incidence of all medical debt as a factor in judging an individual’s credit worthiness.

- Prohibit predatory debt collection practices, including from health care facilities; like foreclosing on homes based on medical liens.

- Strengthen enforcement of debt collection rules and improve transparency.

My Medicaid coverage left me cancer-free and debt-free. I know some people have large bills. For instance, I got a peek into what a single lifesaving chemotherapy treatment could have cost me when I was mistakenly billed $10,000. I have been very fortunate. Affordable health care means consistency in care, not just for me but for my family. While I was receiving my cancer surgeries and treatment, my children were dealing with the fear of losing their mother and fortunately were able to access individual and family therapy as well. Medicaid was there for my children, too.

LAURA RODRIGUEZ

Breast Cancer Survivor

Cap patient out-of-pocket expenses in Medicare. Carla’s profile in this report illustrates how many cancer survivors will benefit from a cap on out-of-pocket expenses in Medicare Part D. ACS CAN strongly supported this policy, which was passed as part of the Inflation Reduction Act in 2022.34 However, patient out-of-pocket spending can still be unlimited in other parts of Medicare (including coverage for hospital and physician services). As health care costs continue to rise, patients need the protection of annual maximum out-of-pocket caps on all covered expenses. While most consumers have this protection in their employer-sponsored or private insurance plan, they lose this protection when they enroll in Medicare. An overall cap would help prevent some people with cancer from falling into medical debt and reduce the amount of debt others may incur while receiving active treatment – and also benefits many cancer survivors who have ongoing high out-of-pocket expenses.

ACS CAN strongly supports efforts to cap patient out-of-pocket spending in Medicare. The organization encourages policymakers to implement the upcoming Part D cap in a way that is protective of beneficiaries and easy to understand. We also encourage Congress to explore capping total out-of-pocket costs in Medicare Parts A and B. Capping out-of-pocket spending in Medicare will reduce the financial toxicity of cancer for Medicare enrollees and will give them more predictability in their annual expenses, which is especially helpful to those on fixed incomes.

Address common insurance coverage problems for cancer survivors. Some cancer survivors encounter cost sharing that is unaffordable or unexpected for treatments they receive related to their cancer history. Additionally, insurance does not cover all necessary treatments. As we saw in Katie’s survivor profile, the costs of uncovered services can be catastrophically high. Common coverage problems in cancer survivorship include:

- Unexpected cost sharing for cancer screenings – It is crucial that cancer survivors get evidence- based, recommended cancer screenings to monitor for secondary cancers. In some cases, guidelines may indicate that survivors need additional screenings beyond what is recommended for the general population. (For example, the guidelines for survivors of childhood cancer indicate that certain survivors begin annual mammograms by age 25 – 20 years before it is recommended the general population begin this screening.35) However, cancer survivors sometimes encounter unexpected cost sharing for these cancer screenings because their provider or insurer has considered the screenings to be cancer surveillance or treatment, instead of a preventive screening. ACS CAN strongly believes that all evidence-based preventive services should be coded as such, and available with no cost sharing, regardless of the patient’s status as a cancer survivor.

- Unaffordable cost sharing for prescription drugs – Many cancer survivors take prescription drugs to prevent cancer recurrence, treat side effects or treat other conditions related and unrelated to their cancer and are vulnerable to high prescription drug costs. Some survivors would benefit from using copay assistance programs, but their insurer uses an “accumulator adjustment program” to prevent any copay assistance from counting toward deductibles and maximum out-of-pocket limits. ACS CAN supports policies that ensure patients can afford their prescription drugs through the use of copay assistance and application of such assistance to out out-of-pocket requirements. We also support caps on copays or annual out-of-pocket spending for prescription drugs.

- Uncovered fertility preservation and fertility treatment services – Treatments that children and young adults receive for cancer may directly impact their ability to conceive or bear children. Approximately 5%-6% of the population in childbearing age consists of cancer survivors. It is important that people with cancer have the option to take actions before treatment to preserve fertility and being required to pay in full for these services leaves many patients without that option. Twelve states have passed laws that require coverage of fertility preservation services in at least some insurance plans regulated by the state.36 ACS CAN supports state policies that require insurance coverage of standard fertility preservation services for people with cancer, as defined by professional guidelines published by the American Society for Reproductive Medicine, the American Society of Clinical Oncology, or other reputable professional medical organizations.

Find system-wide solutions to improve transitions from active treatment to cancer survivorship care. As illustrated in this report, cancer survivors do not all have the same needs in survivorship or follow-up care. Type of cancer diagnosis, age at diagnosis, type of treatment, treatment duration, genetic factors, lifestyle behaviors and comorbidities all play a role in determining the care a survivor needs. Long-term survivorship care that appropriately addresses survivors’ unique health care needs must encompass both oncology-specific care and general primary care. Cancer survivorship care cannot be provided solely by medical oncology teams because there are not enough oncologists to serve everyone, and oncologists receive limited training in non-cancer- related care. Primary care providers cannot provide this care alone because many have limited training in the specific needs of cancer survivors.37

Having insurance provides access to early detection and screenings – allowing you to seek care at an earlier stage. My recent heart problems are a result of my cancer treatment. Having insurance would have kept me from going down a spiral. If you don’t have insurance, they do the cheapest thing to get you by. They will not heal you; they will help you get by. With insurance, they would have taken a biopsy on the lump in my neck. I was a stage I when they finally did the biopsy and was a stage II when I started treatment.

TIM FLOYD

Hodgkin’s Lymphoma Survivor

Survivor Story

Survivor Story

Tim Floyd was living in Mississippi and working in construction in 2019 when he noticed a lump on the side of his throat. He went to the doctor, who said he had enlarged lymph nodes and gave him medication. A year later, Tim went to the doctor again because the lump had grown and was interfering with his singing. The doctor ordered an ultrasound and a biopsy, and after a few weeks, Tim found out he had Hodgkin’s lymphoma.

Tim, who is uninsured, received charity care to cover the cost of his active cancer treatment. However, since going into remission he continues to incur medical bills for follow-up tests and doctor’s visits. He is currently $5,000 in debt and unable to work due to other health conditions. Tim likes his doctor but can only afford to see him once a year to get prescriptions refilled. Each visit costs him $60 cash up front. He knows his doctor is hesitant to order anything extra. So, Tim often doesn’t get the type of tests and screenings he needs.

Today’s health care system needs to adapt to this dichotomy – the growing number of cancer survivors and the diverse needs of this population. ACS CAN supports the building and testing of models of care and payment that support transitions to survivorship care, including building personalized care pathways that take into account differing patient needs and vary the intensity, setting and types of providers involved in care. Creating systems that match the cancer survivor with the right level and types of care for them may create system efficiencies that result in cost savings for payers and patients.

ACS CAN also supports the use of survivorship care plans where proven effective, as well as payment for and coverage of patient navigation services. A patient navigator can be instrumental throughout a patient’s cancer experience starting with diagnosis and into survivorship by ensuring that patients receive the posttreatment care they need – such as nutrition services, physical therapy, and necessary follow-up care – as well as connect patients to emotional support resources. By connecting cancer survivors to these resources, survivors can better prepare for posttreatment costs and needs. Patient navigators are often informed about financial assistance programs or public programs in which eligible patients can enroll. While a patient navigator may not be able to directly address a patient’s direct medical expense issues, they can often serve as a source of information on available financial assistance or aid those patients would not otherwise have or be aware of available resources.

Prohibit the use of genetic information in insurance decisions. Certain variations or mutations in the genetic code can either cause disease or make the development of a disease highly likely. For example, mutations in the BRCA1 and BRCA2 genes are associated with a predisposition toward developing breast, cervical and prostate cancers. Advances in genetic testing capabilities have allowed people to identify these variations in their own genetic code. While this information can help individuals mitigate the onset of disease or better plan for the management of a condition (e.g., starting mammograms at an earlier age or prophylactic mastectomies), this same information could be used by insurers to discriminate against such individuals through denial of coverage or charging higher premiums – which can significantly increase the costs of products like life insurance for cancer survivors.

In 2008, the Genetic Information Nondiscrimination Act (GINA), a bill ACS CAN supported, was passed, barring discrimination in health insurance and employment based on genetic information.38 However, discrimination in long-term care, disability or life insurance based on genetic information is still legal. There have been documented cases of such discrimination against individuals who possess a certain genetic variation, such as the BRCA1 mutation, or who have a family history of a genetic disease, such as Huntington’s disease, even though the individuals in question are perfectly healthy.39, 40 Concerningly, there is evidence that the fear of genetic discrimination in life, long-term and disability insurance is leading individuals to forgo needed cancer screenings or decline participation in clinical trials involving genetic sequencing.41, 42, 43

People with cancer may receive such genetic sequencing to test for genetic predispositions or as part of their cancer treatment (or to prepare for choosing a treatment type), and ACS CAN believes that this decision should not be a detriment to them in their cancer survivorship or cause them to pay higher premiums or costs. Federal and/or state governments should prohibit the use of genetic information in the consideration of life, long-term and disability insurance decisions, including eligibility considerations, rescissions, issuance decisions or setting of premiums. This extends to using health information about family members.

Address environmental factors and social determinants of health that negatively impact a cancer survivor’s ability to remain cancer-free. More than one in five people with cancer in the U.S. struggles to meet their basic needs regarding housing, transportation and/ or food security; and the incidence of these problems is much higher for individuals from historically marginalized populations, including those of Black race, Hispanic ethnicity or living in poverty.44 ACS CAN recognizes that policies, systems and environmental approaches are necessary to support a cancer survivor’s ability to live a healthy life. Where someone lives should not determine their ability to live well beyond a cancer diagnosis. We support policies that address health equity issues in cancer survivorship, including:

- Passing the Health Equity and Accountability Act, which provides a comprehensive set of strategic policy solutions designed to eliminate racial and ethnic health disparities, including those that strengthen health data collection to inform policies, improve diversity in the health care workforce and expand and improve access to health care services45

- Enacting policies that increase access to tobacco cessation services and reduce exposure to secondhand smoke, so that cancer survivors who use tobacco can quit and lessen their exposure to harmful smoke

Concern Over Ability to Pay

In February 2022, ACS CAN surveyed cancer survivors about their experiences with cancer costs and medical debt through our Survivor Views project.

Nearly three-quarters of cancer survivors said they were concerned about their ability to pay current or future costs of their cancer care, and 31% were very concerned. Women, those with lower household income and those with less than a college-level education were especially concerned about their ability to pay.

Endnotes

-

American Cancer Society. Cancer Treatment & Survivorship Facts & Figures 2022-2024. Atlanta: American Cancer Society; 2022.

-

National Center for Health Statistics: National Health Interview Survey, 2019-2020. Public-use data file and documentation.

Retrieved from: https://www.cdc.gov/nchs/nhis/2020nhis.htm. July 2022. -

Agency for Health care Research and Quality: Medical Expenditure Panel Survey, 2018-2019. Public-use data file and documentation.

Retrieved from: https://meps.ahrq.gov/data_stats/download_data_files_detail.jsp?cboPufNumber=HC-216. July 2022. -

American Cancer Society Cancer Action Network. Survivor Views: Cancer & Medical Debt. March 17, 2022. https://www.fightcancer.org/policy-resources/survivor-views-cancer-medical-debt.

-

Cited source defines these terms as follows: “the initial phase, defined as the first 12 months after each diagnosis; the end-of-life (EOL) phase, defined as the 12 months before death among survivors who died, and the continuing phase, the months in-between the initial and the EOL phases.”

-

Angela B. Mariotto, K. Robin Yabroff, Yongwu Shao, Eric J. Feuer, Martin L. Brown, Projections of the Cost of Cancer Care in the United States: 2010–2020, JNCI: Journal of the National Cancer Institute, Volume 103, Issue 2, 19 January 2011, Pages 117–128, https://doi.org/10.1093/jnci/djq495.

-

Ekwueme DU, Zhao J, Rim SH, de Moor JS, Zheng Z, Khushalani JS, Han X, Kent EE, Yabroff KR. Annual Out-of-Pocket Expenditures and Financial Hardship Among Cancer Survivors Aged 18-64 Years - United States, 2011-2016. MMWR Morb Mortal Wkly Rep. 2019 Jun 7;68(22):494-499. doi: 10.15585/mmwr.mm6822a2. PMID: 31170127; PMCID: PMC6553808.

-

Rosenstein DL. Depression and end-of-life care for patients with cancer. Dialogues Clin Neurosci. 2011;13(1):101-8. doi: 10.31887/ DCNS.2011.13.1/drosenstein. PMID: 21485750; PMCID: PMC3181973.

-

Volk, JoAnn. Georgetown University Center on Health Insurance Reforms. The Pandemic Exacerbated Gaps in Mental Health Care Access, but State and Federal Enforcement of Parity Requirements Can Help Improve Coverage. November 15, 2021. http://chirblog.org/pandemic-exacerbated-gaps-mental-health-care-access-state-federal-enforcement-parity-requirements-can-help-improve-coverage/.

-

Silvestri GA, Jemal A, Yabroff KR, Fedewa S, Sineshaw H. Cancer Outcomes Among Medicare Beneficiaries And Their Younger Uninsured Counterparts. Health Affairs. 2021;40(5):754-762. doi:10.1377/hlthaff.2020.01839.

-

Claxton G, Damico A, Oct 04 KPP, 2019. Pre-Existing Condition Prevalence for Individuals and Families. KFF. Published October 4, 2019. https://www.kff.org/health-reform/issue-brief/pre-existing-condition-prevalence-for-individuals-and-families/.

-

Healthcare.gov. Coverage for pre-existing conditions. Access September 9, 2022. https://www.healthcare.gov/coverage/pre-existing-conditions/.

-

National Center for Health Statistics: National Health Interview Survey, 2019-2020. Public-use data file and documentation. Retrieved from: https://www.cdc.gov/nchs/nhis/2020nhis.htm. July 2022.

-

The White House. FACT SHEET: The Biden Administration Announces New Actions to Lessen the Burden of Medical Debt and Increase Consumer Protection. April 11, 2022. https://www.whitehouse.gov/briefing-room/statements-releases/2022/04/11/fact-sheet-the-biden-administration- announces-new-actions-to-lessen-the-burden-of-medical-debt-and-increase-consumer-protection/.

-

Haynes B. THE RACIAL HEALTH and WEALTH GAP IMPACT of MEDICAL DEBT on BLACK FAMILIES.; 2022. https://www.nclc.org/images/pdf/medical-debt/RacialHealth-Rpt-2022.pdf .

-

McKernan, S., Brown, S., Kenney, G., (2017). ”Past-due medical debt a problem, especially for black Americans“, Urban Institute. https://www.urban.org/urban-wire/past-due-medical-debt-problem-especially-black-americans.

-

American Cancer Society Cancer Action Network. The Costs of Cancer 2020 Edition. https://www.fightcancer.org/sites/default/files/National%20Documents/Costs-of-Cancer-2020-10222020.pdf .

-

American Cancer Society/American Society of Clinical Oncology Breast Cancer Survivorship Care Guideline. www.cancer.org. Accessed September 9, 2022. https://www.cancer.org/health-care-professionals/american-cancer-society-survivorship-guidelines/breast-cancer-survivorship-care-guidelines.html

-

Prostate Cancer Survivorship Care Guidelines | American Cancer Society. www.cancer.org. Accessed September 9, 2022. https://www.cancer.org/health-care-professionals/american-cancer-society-survivorship-guidelines/prostate-cancer-survivorship-care-guideline.html .

-

Children’s Oncology Group. www.survivorshipguidelines.org. http://www.survivorshipguidelines.org/ .

-

Jingxuan Zhao, Xuesong Han, Leticia Nogueira, Zhiyuan Zheng, Ahmedin Jemal, K. Robin Yabroff; Health Insurance Coverage Disruptions and Access to Care and Affordability among Cancer Survivors in the United States. Cancer Epidemiol Biomarkers Prev 1 November 2020; 29 (11): 2134–2140. https://doi.org/10.1158/1055-9965.EPI-20-0518

-

Jiang, Changchuan et al. Dobbs v Jackson and access to fertility care among newly diagnosed adolescents and young adults with cancer in the USA. The Lancet Oncology, Volume 23, Issue 10, 1240 – 1243.

-

American Cancer Society Cancer Action Network. The Costs of Cancer 2020 Edition. https://www.fightcancer.org/sites/default/files/National%20Documents/Costs-of-Cancer-2020-10222020.pdf

-

Harker, Laura. Center on Budget and Policy Priorities. Closing the Coverage Gap a Critical Step for Advancing Health and Economic Justice. October 4, 2021. https://www.cbpp.org/research/health/closing-the-coverage-gap-a-critical-step-for-advancing-health-and-economic-justice

-

Karen Pollitz, High-Risk Pools for Uninsurable Individuals, Kaiser Family Found. February 2017, available at http://kff.org/health-reform/issue-brief/high-risk-pools-for-uninsurable-individuals/ .

-

American Cancer Society Cancer Action Network. Inadequate Coverage: An ACS CAN Examination of Short-Term Health Plans. May 13, 2019. https://www.fightcancer.org/releases/acs-can-report-short-term-insurance-coverage-inadequate-confusing-and-expensive-patients .

-

Milliman. The impact of short-term limited-duration policy expansion on patients and the ACA individual market. February 2020. https://www.lls.org/sites/default/files/National/USA/Pdf/STLD-Impact-Report-Final-Public.pdf .

-

Banegas MP, Guy GP, de Moor JS, et al. For Working-Age Cancer Survivors, Medical Debt And Bankruptcy Create Financial Hardships. Health Aff (Millwood). 2016;35(1):54-61. doi:10.1377/hlthaff.2015.0830.

-

Death or Debt? National Estimates of Financial Toxicity in Persons with Newly-Diagnosed Cancer - The American Journal of Medicine. Accessed April 9, 2021. https://www.amjmed.com/article/S0002-9343(18)30509-6/fulltext/

-

Doroudi M, Coughlan D, Banegas MP, Han X, Robin Yabroff K. Is Cancer History Associated With Assets, Debt, and Net Worth in the United States? JNCI Cancer Spectr. 2018;2(2):pky004. doi:10.1093/jncics/pky004.

-

Ramsey SD, Blough DK, Kirchhoff AC, et al. Washington Cancer Patients Found To Be At Greater Risk For Bankruptcy Than People Without A Cancer Diagnosis. Health Aff (Millwood). 2013;32(6):1143-1152. doi:10.1377/hlthaff.2012.1263.

-

Banegas MP, Schneider JL, Firemark AJ, et al. The social and economic toll of cancer survivorship: a complex web of financial sacrifice. J Cancer Surviv. 2019;13(3):406-417. doi:10.1007/s11764-019-00761-1.

-

American Cancer Society Cancer Action Network. Survivor Views: Cancer & Medical Debt. February 2022 Survey Findings Summary. https://www.fightcancer.org/sites/default/files/national_documents/survivor_views_cancer_debt_0.pdf .

-

American Cancer Society Cancer Action Network. Cancer Patients and Survivors Cheer Final Passage of Inflation Reduction Act. August 12, 2022. https://www.fightcancer.org/releases/cancer-patients-and-survivors-cheer-final-passage-inflation-reduction-act

-

Children’s Oncology Group. Long-Term Follow-Up Guidelines for Survivors of Childhood, Adolescent, and Young Adult Cancers: Version 5.0. October 2018. http://www.survivorshipguidelines.org/pdf/2018/COG_LTFU_Guidelines_v5.pdf

-

Alliance for Fertility Preservation. State Laws & Legislation. Updated September 28, 2022. Accessed October 10, 2022. https://www.allianceforfertilitypreservation.org/state-legislation/ .

-

Leach CR, Alfano CM, Potts J, Gallicchio L, Yabroff KR, Oeffinger KC, Hahn EE, Shulman LN, Hudson SV. Personalized Cancer Follow-Up Care Pathways: A Delphi Consensus of Research Priorities. J Natl Cancer Inst. 2020 Dec 14;112(12):1183-1189. doi: 10.1093/jnci/djaa053. PMID: 32333765; PMCID: PMC7735765.

-

Genetic Information Nondiscrimination Act (GINA). National Human Genome Research Institute. Accessed March 18, 2021. https://www.genome.gov/genetics-glossary/Genetic-Information-Nondiscrimination-Act .

-

Farr C. If You Want Life Insurance, Think Twice Before Getting a Genetic Test. Fast Company. Published February 17, 2016. Accessed March 18, 2021. https://www.fastcompany.com/3055710/if-you-want-life-insurance-think-twice-before-getting-genetic-testing?utm_source=mailchimp&utm_medium=email&utm_campaign=fast-company-daily-newsletter&position=8&partner=newsletter&campaign_date=02172016 .

-

Erwin C, Williams JK, Juhl AR, et al. Perception, experience, and response to genetic discrimination in Huntington disease: The international RESPOND-HD study. Am J Med Genet. 2010;9999B:n/a-n/a. doi:10.1002/ajmg.b.31079.

-

Parkman AA, Foland J, Anderson B, et al. Public Awareness of Genetic Nondiscrimination Laws in Four States and Perceived Importance of Life Insurance Protections. J Genet Counsel. 2015;24(3):512-521. doi:10.1007/s10897-014-9771-y.

-

Allain DC, Friedman S, Senter L. Consumer awareness and attitudes about insurance discrimination post enactment of the Genetic Information Nondiscrimination Act. Familial Cancer. 2012;11(4):637-644. doi:10.1007/s10689-012-9564-0.

-

Robinson JO, Carroll TM, Feuerman LZ, et al. Participants and Study Decliners’ Perspectives About the Risks of Participating in a Clinical Trial of Whole Genome Sequencing. Journal of Empirical Research on Human Research Ethics. 2016;11(1):21-30. doi:10.1177/1556264615624078.

-

American Cancer Society. Food, Housing, Transportation Insecurity Associated with Disparities in Cancer Care and Patient Outcomes, New Research Shows. September 21, 2022. http://pressroom.cancer.org/socialdeterminants

-

For more information, please visit https://www.fightcancer.org/releases/house-introduces-health-equity-bill-critical-reducing-health-disparities-and-fighting .